Rising Complexity of Tax Regulations

the tax accounting-software market is influenced by the rising complexity of tax regulations, a significant driver for software adoption. As tax codes evolve and become more intricate, businesses require robust software solutions to navigate these challenges effectively. In 2025, it is projected that the average business will face over 100 changes in tax regulations annually, necessitating the use of advanced software that can adapt to these changes. This complexity not only increases the risk of non-compliance but also heightens the demand for software that can provide comprehensive tax planning and reporting features. Thus, the tax accounting-software market is likely to expand as companies seek reliable tools to manage their tax obligations.

Increasing Regulatory Compliance Requirements

the tax accounting-software market is experiencing a surge in demand due to increasing regulatory compliance requirements imposed by federal and state authorities. Businesses are compelled to adopt sophisticated software solutions to ensure adherence to tax laws and regulations. In 2025, it is estimated that compliance-related costs could account for up to 10% of total operational expenses for small to medium-sized enterprises. This trend necessitates the integration of advanced features in tax accounting software, such as real-time updates on tax law changes and automated reporting functionalities. As a result, software providers are focusing on enhancing their offerings to meet these compliance demands, thereby driving growth in the tax accounting-software market.

Growing Demand for Automation in Tax Processes

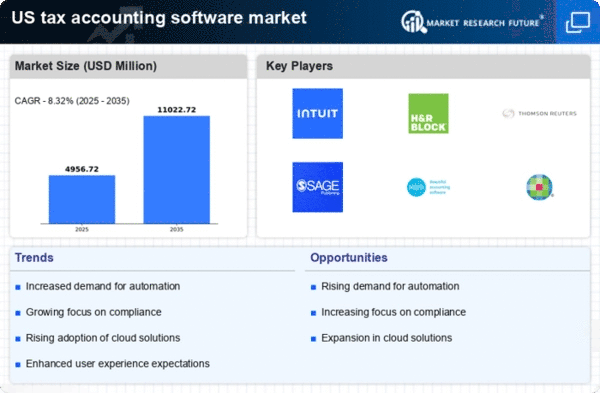

The tax accounting-software market is witnessing a growing demand for automation in tax processes, as businesses seek to streamline their operations and reduce manual errors. Automation can significantly enhance efficiency, with studies indicating that automated tax processes can reduce processing time by up to 50%. This shift towards automation is particularly evident among larger corporations that handle complex tax scenarios. The need for accurate and timely tax filings is paramount, and software solutions that offer automated calculations, document management, and e-filing capabilities are becoming increasingly popular. Consequently, this trend is propelling the growth of the tax accounting-software market, as companies invest in technology to optimize their tax functions.

Shift Towards Remote Work and Digital Solutions

The tax accounting-software market is experiencing a shift towards remote work and digital solutions, driven by the increasing acceptance of flexible work arrangements. As more professionals work remotely, there is a heightened need for cloud-based tax accounting solutions that facilitate collaboration and accessibility. In 2025, it is estimated that over 60% of tax professionals will utilize cloud-based software for their operations. This trend is prompting software developers to enhance their platforms with features that support remote access, data sharing, and real-time collaboration. Consequently, the tax accounting-software market is likely to see significant growth as businesses adapt to this new work environment and seek solutions that align with their operational needs.

Emergence of Advanced Analytics and Reporting Tools

The tax accounting-software market is being propelled by the emergence of advanced analytics and reporting tools that provide businesses with deeper insights into their tax positions. These tools enable organizations to analyze tax data more effectively, identify trends, and make informed decisions. In 2025, it is anticipated that approximately 40% of tax software users will prioritize analytics capabilities in their software selection process. The ability to generate detailed reports and forecasts can enhance strategic planning and compliance efforts. As a result, software providers are increasingly incorporating advanced analytics features into their offerings, thereby driving innovation and growth within the tax accounting-software market.