Emergence of Edge Computing

The rise of edge computing is influencing the US supercomputer market by shifting some computational tasks closer to data sources. This trend is driven by the need for real-time data processing and analysis, particularly in sectors such as autonomous vehicles, smart cities, and IoT applications. While traditional supercomputers are designed for centralized processing, the integration of edge computing can enhance overall system efficiency and responsiveness. As organizations seek to optimize their computing resources, the demand for hybrid solutions that combine supercomputing with edge capabilities is likely to grow. This evolution may lead to new business models and opportunities within the US supercomputer market, as companies adapt to the changing technological landscape.

Advancements in Quantum Computing

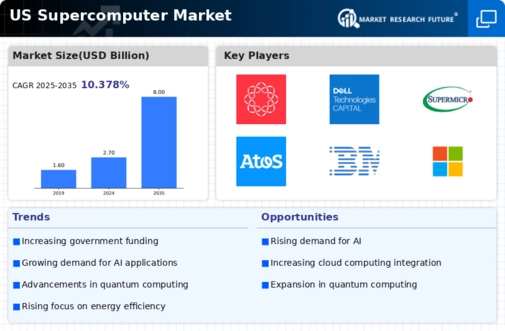

The emergence of quantum computing is poised to revolutionize the US supercomputer market. As researchers explore the potential of quantum technologies, there is a growing interest in integrating quantum computing capabilities with traditional supercomputers. This convergence could lead to unprecedented computational power, enabling the resolution of complex problems that are currently intractable. Major tech companies and research institutions in the US are investing heavily in quantum research, with projections indicating that the quantum computing market could reach 8 billion dollars by 2027. The integration of quantum computing into the supercomputer landscape may enhance the capabilities of existing systems, thereby attracting more users and applications to the US supercomputer market.

Government Initiatives and Funding

The US government has been actively promoting the development of the supercomputer market through various initiatives and funding programs. Agencies such as the Department of Energy (DOE) and the National Science Foundation (NSF) have allocated substantial budgets to support research and development in high-performance computing. For instance, the DOE's Exascale Computing Project aims to deliver supercomputers capable of performing a billion calculations per second. Such government backing not only fosters innovation but also encourages collaboration between public and private sectors, thereby propelling the growth of the US supercomputer market. This strategic investment is expected to yield advancements in computational science and engineering, further solidifying the US's position as a leader in supercomputing.

Growing Demand for High-Performance Computing

The US supercomputer market is experiencing a notable surge in demand for high-performance computing (HPC) solutions. This demand is primarily driven by the need for advanced data processing capabilities across various sectors, including healthcare, finance, and scientific research. As organizations increasingly rely on data-intensive applications, the market for supercomputers is projected to grow significantly. According to recent estimates, the US supercomputer market is expected to reach a valuation of over 30 billion dollars by 2026. This growth is indicative of the critical role that supercomputers play in enabling complex simulations, modeling, and analytics, thereby enhancing decision-making processes in numerous industries.

Increased Focus on Climate Modeling and Simulation

The US supercomputer market is witnessing an increased focus on climate modeling and simulation as the urgency to address climate change intensifies. Supercomputers play a pivotal role in simulating climate patterns, predicting weather events, and assessing the impact of environmental changes. Government agencies, research institutions, and private organizations are investing in supercomputing resources to enhance their climate research capabilities. For example, the National Oceanic and Atmospheric Administration (NOAA) has been utilizing supercomputers to improve weather forecasting accuracy. This trend is likely to drive demand for advanced supercomputing solutions, as stakeholders seek to leverage high-performance computing for more accurate climate predictions and effective policy-making.