Expansion of E-Commerce Platforms

The expansion of e-commerce platforms is significantly impacting the smart toys market, facilitating easier access for consumers. Online shopping has become increasingly popular, with a substantial % of toy sales now occurring through digital channels. This shift is supported by market data showing that e-commerce sales in the smart toys market are projected to increase by 40% by 2027. The convenience of online shopping, coupled with the ability to compare products and read reviews, is driving more consumers to purchase smart toys online. As e-commerce continues to grow, it is likely to influence marketing strategies and distribution channels, ultimately shaping the future landscape of the smart toys market.

Growing Demand for Interactive Learning

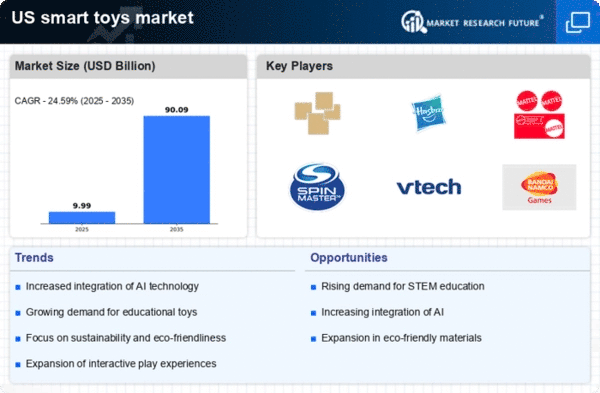

The smart toys market is experiencing a surge in demand for interactive learning tools. Parents increasingly seek educational toys that not only entertain but also promote cognitive development. This trend is reflected in the market data, which indicates that the segment of educational smart toys is projected to grow at a CAGR of 15% from 2025 to 2030. The appeal lies in toys that adapt to a child's learning pace, providing personalized experiences. As educational standards evolve, the smart toys market is likely to align with these changes, offering products that support STEM learning and critical thinking skills. This growing emphasis on interactive learning is reshaping consumer preferences, driving innovation, and expanding the market's reach across various demographics.

Technological Advancements in Toy Design

Technological advancements are significantly influencing the smart toys market, leading to innovative designs and functionalities. The integration of augmented reality (AR) and virtual reality (VR) into toys is becoming more prevalent, enhancing user engagement. For instance, toys that utilize AR can create immersive experiences, allowing children to interact with digital elements in their physical environment. This trend is supported by market data indicating that the AR segment within the smart toys market is expected to grow by 20% annually through 2028. As manufacturers invest in research and development, the introduction of cutting-edge technologies is likely to attract tech-savvy consumers, further propelling the market's expansion.

Increased Focus on Child Safety Standards

The smart toys market is witnessing a focus on child safety standards, which is a critical driver for growth. Regulatory bodies are implementing stricter safety guidelines to ensure that toys are free from harmful materials and pose no risk to children. This heightened scrutiny is prompting manufacturers to prioritize safety in their product designs. Market data suggests that toys meeting these enhanced safety standards are gaining traction, with a projected increase in sales of compliant products by 30% over the next five years. As parents become more aware of safety issues, their purchasing decisions are likely to favor brands that demonstrate a commitment to high safety standards, thereby influencing the overall dynamics of the smart toys market.

Rising Popularity of Subscription-Based Models

The smart toys market is shifting towards subscription-based models, which are gaining popularity among consumers. This model allows parents to receive a curated selection of toys delivered to their homes regularly, providing variety and convenience. Market analysis indicates that subscription services in the smart toys market are expected to grow by 25% annually, appealing to families seeking innovative and engaging toys without the hassle of constant shopping. This trend not only enhances customer loyalty but also encourages manufacturers to continuously innovate, as they must provide fresh and exciting products to retain subscribers. The subscription model is likely to reshape purchasing behaviors and foster a more dynamic market environment.