Advancements in Antenna Technology

the market is experiencing significant advancements in antenna technology, which are crucial for enhancing communication capabilities. Innovations such as phased array antennas and electronically steered antennas are improving the efficiency and performance of ground stations. These technologies enable faster data transmission and better signal quality, which are essential for modern satellite applications. The market for advanced antenna systems is expected to grow by 12% over the next five years, driven by the increasing demand for high-speed internet and real-time data services. As a result, the satellite ground-station-equipment market is likely to see a shift towards more sophisticated antenna solutions, catering to the evolving needs of users.

Emergence of New Satellite Constellations

the market is witnessing a transformation due to the emergence of new satellite constellations. Companies like SpaceX and OneWeb are launching large fleets of low Earth orbit (LEO) satellites, which require advanced ground-station equipment for effective operation. This trend is expected to create a market opportunity valued at approximately $3 billion by 2027. The need for ground stations that can handle multiple satellite signals simultaneously is becoming increasingly critical. As these constellations expand, the satellite ground-station-equipment market is likely to evolve, necessitating innovative solutions to manage the complexities of LEO satellite communications.

Government Investments in Space Infrastructure

The satellite ground-station-equipment market is benefiting from substantial government investments aimed at enhancing space infrastructure. The U.S. government has allocated significant funding to support satellite programs, which is expected to exceed $20 billion by 2026. This investment is primarily focused on improving national security, disaster response capabilities, and scientific research. As a result, the demand for sophisticated ground-station equipment is anticipated to increase, as these systems are essential for monitoring and controlling satellite operations. The government's commitment to advancing space technology not only stimulates market growth but also encourages private sector participation, fostering innovation within the satellite ground-station-equipment market.

Increased Focus on Data Security and Encryption

the market is increasingly prioritizing data security and encryption measures. With the rise in cyber threats and the critical nature of satellite communications, stakeholders are investing in advanced security protocols to protect sensitive information. The market for secure satellite communication equipment is projected to grow by 10% annually, reflecting the heightened awareness of security risks. This focus on data integrity and confidentiality is driving demand for ground-station equipment that incorporates robust encryption technologies. As organizations seek to safeguard their communications, the satellite ground-station-equipment market is likely to adapt, offering solutions that meet stringent security requirements.

Growing Demand for Satellite Communication Services

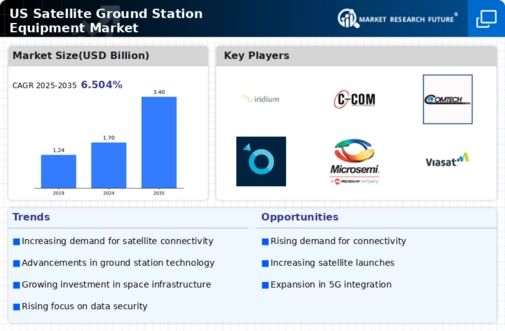

the satellite ground-station-equipment market is experiencing a notable surge in demand for communication services via satellite. This growth is driven by the increasing reliance on satellite technology for various applications, including telecommunications, broadcasting, and internet services. As of 2025, the market is projected to reach approximately $5 billion, reflecting a compound annual growth rate (CAGR) of around 8% over the next five years. The expansion of 5G networks and the need for reliable communication in remote areas further contribute to this trend. Consequently, the demand for advanced ground-station equipment, which ensures seamless connectivity and data transmission, is likely to rise significantly, thereby enhancing the overall market landscape.