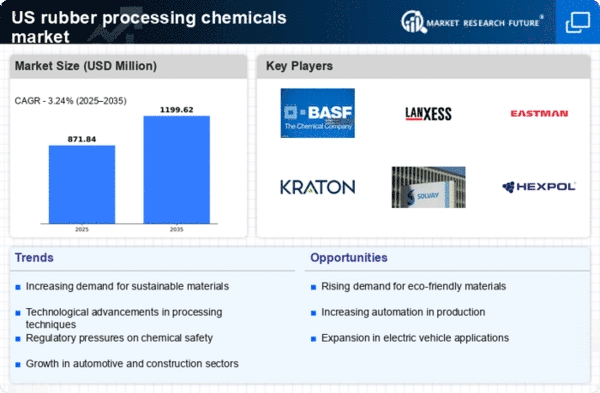

The rubber processing-chemicals market is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Key players such as BASF SE (DE), Eastman Chemical Company (US), and Kraton Corporation (US) are actively shaping the market through their distinct operational focuses. BASF SE (DE) emphasizes innovation in sustainable solutions, aiming to reduce environmental impact while enhancing product performance. Eastman Chemical Company (US) is concentrating on digital transformation and supply chain optimization, which appears to enhance operational efficiency and customer engagement. Meanwhile, Kraton Corporation (US) is pursuing strategic partnerships to expand its product offerings and market reach, indicating a trend towards collaborative growth in the sector.The business tactics employed by these companies reflect a moderately fragmented market structure, where localized manufacturing and supply chain optimization are pivotal. The collective influence of these key players suggests a competitive environment that is increasingly focused on sustainability and technological advancement. As companies localize their manufacturing processes, they not only reduce costs but also enhance their responsiveness to market demands, thereby strengthening their competitive positions.

In October BASF SE (DE) announced a new initiative aimed at developing bio-based rubber processing chemicals, which is expected to significantly reduce carbon emissions associated with traditional production methods. This strategic move underscores BASF's commitment to sustainability and positions the company as a leader in eco-friendly innovations within the market. Similarly, in September 2025, Eastman Chemical Company (US) launched a digital platform designed to streamline customer interactions and improve supply chain transparency. This initiative is likely to enhance customer satisfaction and operational efficiency, reflecting a broader trend towards digitalization in the industry.

In August Kraton Corporation (US) entered into a strategic partnership with a leading technology firm to develop advanced polymer solutions for the automotive sector. This collaboration is anticipated to leverage cutting-edge technologies, thereby enhancing product performance and expanding market opportunities. Such strategic alliances are indicative of a shift towards innovation-driven competition, where companies seek to differentiate themselves through technological advancements rather than solely on price.

As of November the competitive trends in the rubber processing-chemicals market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are playing a crucial role in shaping the current landscape, enabling companies to pool resources and expertise. Looking ahead, it appears that competitive differentiation will evolve, with a pronounced shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition suggests that companies that prioritize sustainable practices and technological integration are likely to gain a competitive edge in the evolving market.