Heightened Regulatory Scrutiny

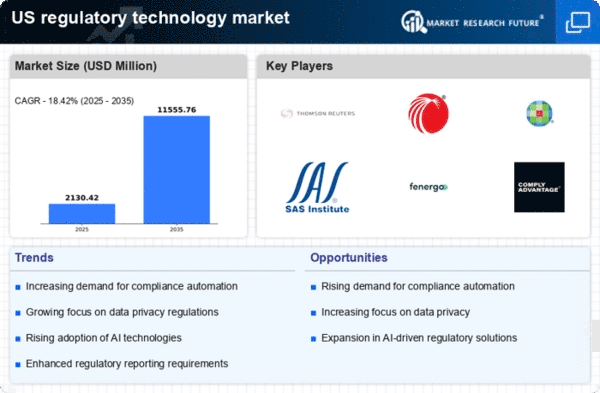

The regulatory technology market is experiencing a surge in demand due to heightened scrutiny from regulatory bodies. In the US, agencies such as the SEC and FINRA are intensifying their oversight, compelling organizations to adopt robust compliance solutions. This trend is reflected in the market's projected growth, with estimates suggesting a CAGR of approximately 20% over the next five years. Companies are increasingly investing in regulatory technology to ensure adherence to evolving regulations, thereby mitigating risks associated with non-compliance. The need for real-time monitoring and reporting capabilities is driving innovation within the regulatory technology market, as firms seek to enhance their compliance frameworks and avoid costly penalties.

Increased Focus on Risk Management

The regulatory technology market increasingly focuses on risk management as organizations recognize the importance of proactive compliance strategies. In the US, firms are adopting regulatory technology solutions to identify, assess, and mitigate risks associated with regulatory compliance. This shift is driven by the need for organizations to protect their reputations and financial stability. Market Research Future indicates that the risk management segment within the regulatory technology market is expected to grow by over 25% in the coming years. As businesses prioritize risk management, the demand for innovative regulatory technology solutions that provide comprehensive risk assessments and reporting capabilities is likely to rise.

Emergence of Data Privacy Regulations

The emergence of stringent data privacy regulations in the US significantly influences the regulatory technology market. Laws such as the California Consumer Privacy Act (CCPA) and the proposed federal privacy legislation are reshaping how organizations manage personal data. As businesses strive to comply with these regulations, the demand for regulatory technology solutions is expected to rise. Market analysts indicate that the data privacy segment could account for over 30% of the overall regulatory technology market by 2026. This shift necessitates the development of advanced tools that facilitate data governance, risk assessment, and compliance management, thereby propelling growth in the regulatory technology market.

Technological Advancements in Compliance Solutions

Technological advancements are playing a pivotal role in shaping the regulatory technology market. Innovations such as artificial intelligence (AI), machine learning, and blockchain are enhancing compliance solutions, making them more efficient and effective. For instance, AI-driven analytics can process vast amounts of data to identify compliance risks, while blockchain technology offers secure and transparent transaction records. The integration of these technologies is expected to drive market growth, with projections indicating that the market could reach $10 billion by 2027. As organizations seek to leverage these advancements, the regulatory technology market is likely to witness increased investment and development of cutting-edge solutions.

Growing Demand for Cost-Effective Compliance Solutions

The regulatory technology market is seeing increased demand for cost-effective compliance solutions as organizations seek to optimize their compliance budgets. With regulatory fines and penalties on the rise, companies are seeking technologies that can streamline compliance processes while reducing operational costs. This trend is particularly evident in small to medium-sized enterprises (SMEs) that may lack the resources for extensive compliance departments. Market data suggests that the adoption of regulatory technology can reduce compliance costs by up to 30%, making it an attractive option for businesses. As the need for affordable compliance solutions continues to grow, the regulatory technology market is likely to expand to meet these demands.