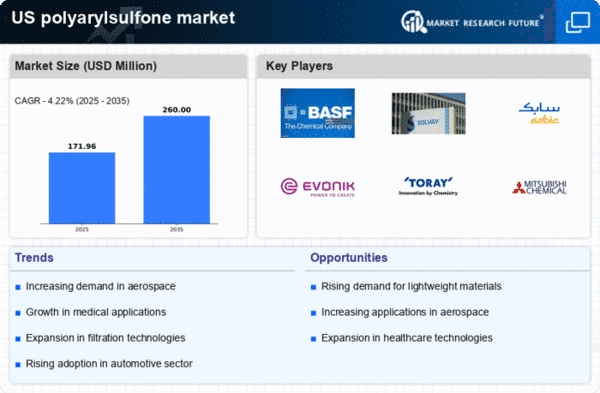

The polyarylsulfone market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as BASF SE (Germany), Solvay SA (Belgium), and SABIC (Saudi Arabia) are actively shaping the market through their focus on advanced materials and sustainable solutions. BASF SE (Germany) emphasizes innovation in high-performance polymers, while Solvay SA (Belgium) is enhancing its product portfolio to meet the growing demand for lightweight and durable materials. SABIC (Saudi Arabia) is strategically expanding its manufacturing capabilities to cater to diverse applications, thereby reinforcing its market position. Collectively, these strategies foster a competitive environment that prioritizes technological advancement and sustainability.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several key players exerting considerable influence. This fragmentation allows for a variety of competitive strategies, enabling companies to differentiate themselves through specialized offerings and customer-centric solutions.

In October BASF SE (Germany) announced a partnership with a leading aerospace manufacturer to develop lightweight polyarylsulfone components aimed at reducing aircraft weight and improving fuel efficiency. This collaboration underscores BASF's commitment to innovation and positions it favorably within the aerospace sector, where material performance is critical. The strategic importance of this partnership lies in its potential to open new market opportunities and enhance BASF's reputation as a leader in high-performance materials.

In September Solvay SA (Belgium) launched a new line of polyarylsulfone products designed specifically for medical applications, emphasizing biocompatibility and regulatory compliance. This move not only diversifies Solvay's product offerings but also aligns with the increasing demand for advanced materials in the healthcare sector. The strategic significance of this launch is evident in its potential to capture a larger share of the medical device market, which is experiencing robust growth.

In August SABIC (Saudi Arabia) expanded its production facility in the US to increase the output of polyarylsulfone resins. This expansion is indicative of SABIC's strategy to enhance its supply chain capabilities and meet the rising demand for high-performance materials across various industries. The strategic importance of this facility expansion lies in its ability to bolster SABIC's market presence and improve responsiveness to customer needs.

As of November current competitive trends in the polyarylsulfone market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming pivotal in shaping the landscape, as companies collaborate to leverage complementary strengths. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that companies prioritizing R&D and sustainable practices will be better positioned to thrive in an increasingly competitive environment.