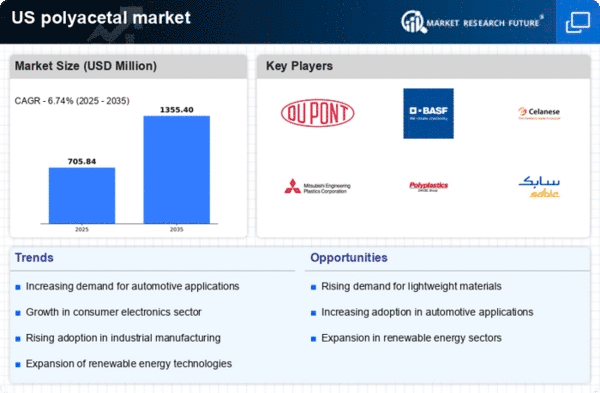

The polyacetal market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as DuPont (US), BASF (DE), and Celanese (US) are actively shaping the market through various operational strategies. DuPont (US) focuses on enhancing its product portfolio with advanced materials, while BASF (DE) emphasizes sustainability in its manufacturing processes. Celanese (US) is leveraging digital transformation to optimize its supply chain and improve customer engagement. Collectively, these strategies foster a competitive environment that prioritizes technological advancement and sustainability, driving growth in the sector.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and enhance responsiveness to market demands. Supply chain optimization remains a critical focus, particularly in light of recent global disruptions. The market structure appears moderately fragmented, with a mix of established players and emerging companies vying for market share. The collective influence of these key players is significant, as they set industry standards and drive innovation.

In October DuPont (US) announced a partnership with a leading automotive manufacturer to develop high-performance polyacetal components aimed at reducing vehicle weight and enhancing fuel efficiency. This strategic move underscores DuPont's commitment to innovation and positions it favorably within the automotive sector, which is increasingly focused on sustainability and performance.

In September BASF (DE) launched a new line of bio-based polyacetal products, reflecting its dedication to sustainable practices. This initiative not only aligns with global environmental goals but also caters to the growing demand for eco-friendly materials in various applications, potentially enhancing BASF's market share in the green materials segment.

In August Celanese (US) expanded its production capacity for polyacetal resins in North America, a decision driven by increasing demand from the electronics and automotive industries. This expansion is likely to strengthen Celanese's competitive position and enable it to meet the rising needs of its customers more effectively.

As of November the competitive trends in the polyacetal market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing supply chain reliability. Looking ahead, competitive differentiation is expected to evolve, shifting from price-based competition to a focus on technological innovation and sustainable practices, which will be crucial for long-term success in this market.