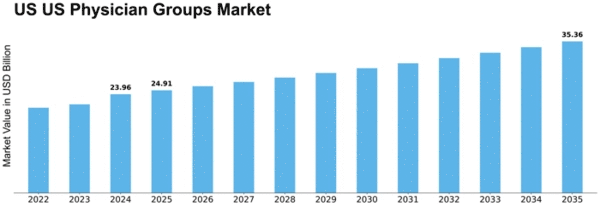

Us Physician Groups Size

US Physician Groups Market Growth Projections and Opportunities

Many factors influence the U.S. physician groups market, which impacts the healthcare system. Key issue: shifting legal environment. The US healthcare business must observe several laws. These include payment, quality, and EHRs. Healthcare policy and regulatory changes may impact medical organizations' operations and finances, affecting their decision-making and strategy. Value-based care is another market driver. Recently, value-based payment methods have grown more essential than fee-for-service approaches. This modification aims to enhance patient outcomes and save expenses. Physician groups are increasingly using value-based contracts, which pay for quality and efficiency. Medical groups must embrace innovative treatment methods, invest in technology, and collaborate with other healthcare institutions to enhance patient outcomes. Consolidation also impacts the U.S. physician groups market. Medical organizations have been merging and buying one other to form larger healthcare corporations. Consolidation may boost economies of scale, payer negotiating power, and technology adoption resources. But it also raises concerns about anti-competitive practices and healthcare costs. Medical firms must weigh the merits and downsides of combining to adapt to the changing market. The U.S. medical group market relies on technology adoption and integration. Telemedicine, EHRs, and other digital health technologies are becoming more crucial to healthcare. Technology may enhance patient care, simplify regular chores, and aid data-driven decision-making. As they employ technology to enhance speed and patient outcomes, medical organizations must consider high adoption costs, sharing issues, and data security concerns. Population affects the U.S. medical group market. We need more healthcare since people are living longer and having chronic diseases. Due to this demographic shift, medical organizations must prepare for elderly patients' healthcare demands. These strategies should emphasize preventative care, chronic illness management, and multidisciplinary treatment. Money and remuneration affect medical organizations' capacity to survive. Compensation rates, payment schemes, and payer mix might impact medical organizations' financial stability. Flexibility and financial planning are needed to keep medical organizations financially viable and provide high-quality service.

Leave a Comment