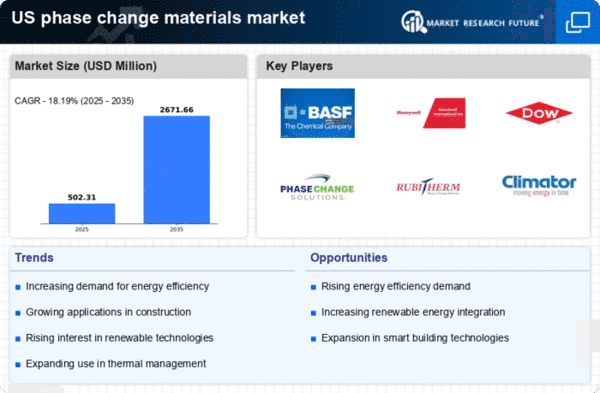

The phase change-materials market is currently characterized by a dynamic competitive landscape, driven by increasing demand for energy-efficient solutions across various sectors, including construction, electronics, and textiles. Key players such as BASF SE (DE), Honeywell International Inc. (US), and Dow Inc. (US) are strategically positioned to leverage their extensive research and development capabilities to innovate and enhance product offerings. These companies are focusing on sustainability and digital transformation, which are becoming essential in shaping their operational strategies. The collective efforts of these firms contribute to a moderately fragmented market structure, where competition is intensifying as companies seek to differentiate themselves through technological advancements and strategic partnerships.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. This approach not only enhances operational efficiency but also aligns with the growing consumer preference for locally sourced products. The competitive structure of the market remains moderately fragmented, with several players vying for market share. The influence of key players is significant, as their strategic initiatives often set industry standards and drive innovation.

In October Honeywell International Inc. (US) announced the launch of a new line of phase change materials designed specifically for the HVAC industry. This strategic move is expected to enhance energy efficiency in residential and commercial buildings, aligning with the growing emphasis on sustainability. By targeting the HVAC sector, Honeywell aims to capitalize on the increasing regulatory pressures for energy-efficient solutions, thereby reinforcing its market position.

In September Dow Inc. (US) expanded its partnership with a leading construction firm to integrate phase change materials into building materials. This collaboration is significant as it not only broadens Dow's product portfolio but also positions the company as a key player in the sustainable construction market. The integration of these materials is likely to enhance thermal performance, thereby reducing energy consumption in buildings.

In August Phase Change Energy Solutions Inc. (US) secured a contract to supply phase change materials for a large-scale renewable energy project. This contract underscores the growing recognition of phase change materials in energy storage applications, particularly in renewable energy systems. The strategic importance of this move lies in its potential to enhance the efficiency of energy storage solutions, thereby supporting the transition to a more sustainable energy landscape.

As of November current trends in the phase change-materials market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance innovation and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift indicates a broader trend where companies that prioritize sustainable practices and technological advancements will likely emerge as leaders in the market.