US Paraformaldehyde Market Summary

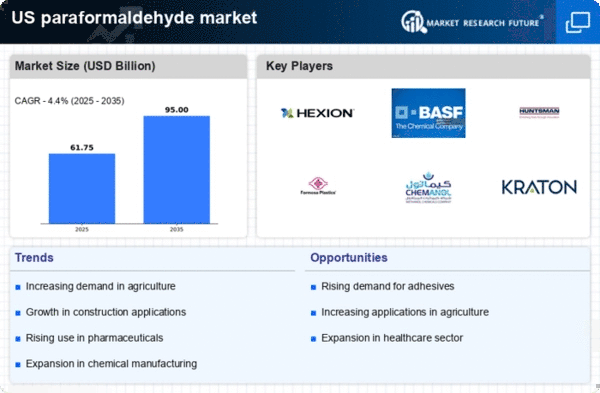

As per Market Research Future analysis, the US paraformaldehyde market Size was estimated at 59.15 $ Billion in 2024. The US paraformaldehyde market is projected to grow from 61.75 $ Billion in 2025 to 95.0 $ Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US paraformaldehyde market is experiencing a dynamic shift driven by sustainability and technological advancements.

- Sustainability initiatives are increasingly shaping the production and application of paraformaldehyde in various industries.

- Technological advancements are enhancing the efficiency and safety of paraformaldehyde manufacturing processes.

- The agriculture segment remains the largest consumer of paraformaldehyde, while the healthcare segment is emerging as the fastest-growing application area.

- Rising demand in agriculture and regulatory support for chemical manufacturing are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 59.15 (USD Billion) |

| 2035 Market Size | 95.0 (USD Billion) |

| CAGR (2025 - 2035) | 4.4% |

Major Players

Hexion Inc (US), BASF SE (DE), Huntsman Corporation (US), Formosa Plastics Corporation (TW), Chemanol (SA), Kraton Corporation (US), SABIC (SA), Ercros S.A. (ES), Mitsui Chemicals, Inc. (JP)