Rising Data Traffic

The optical transport-network market is experiencing a surge in data traffic driven by the proliferation of digital services and applications. As businesses and consumers increasingly rely on cloud computing, streaming services, and IoT devices, the demand for high-capacity data transmission escalates. Reports indicate that data traffic in the US is projected to grow at a CAGR of approximately 25% over the next five years. This growth necessitates robust optical transport networks capable of handling vast amounts of data efficiently. Consequently, service providers are investing heavily in optical transport solutions to enhance their network capabilities, thereby propelling the optical transport-network market forward.

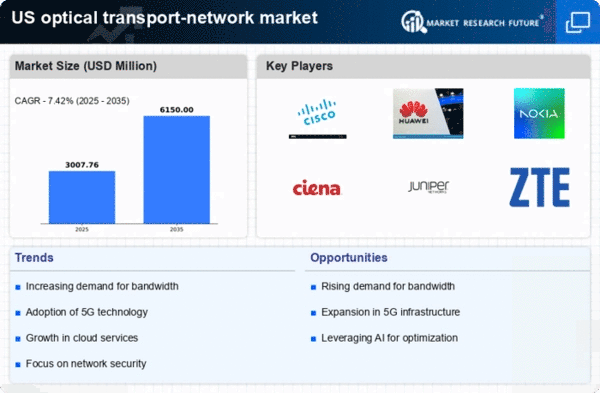

Shift Towards 5G Networks

The transition to 5G networks is a pivotal driver for the optical transport-network market. 5G technology demands higher bandwidth and lower latency, which optical transport networks are well-equipped to provide. As telecommunications companies in the US roll out 5G infrastructure, they require advanced optical transport solutions to support the increased data rates and connectivity needs. the optical transport-network market will see a substantial uptick in demand as 5G adoption accelerates, with estimates suggesting that the market could grow by over 30% in the next few years due to this shift. This trend underscores the critical role of optical transport networks in enabling next-generation mobile communications.

Emergence of Cloud Services

The rapid adoption of cloud services is reshaping the optical transport-network market. As organizations migrate their operations to the cloud, the need for reliable and high-speed data transmission becomes paramount. Optical transport networks provide the necessary infrastructure to support these cloud-based applications, ensuring seamless connectivity and data transfer. The market for cloud services in the US is projected to reach $500 billion by 2025, further driving the demand for optical transport solutions. This trend indicates that as more businesses leverage cloud technologies, the optical transport-network market will likely experience significant growth, as it plays a crucial role in facilitating cloud connectivity.

Government Initiatives and Funding

Government initiatives aimed at enhancing broadband access and digital infrastructure are significantly impacting the optical transport-network market. Various federal and state programs are allocating substantial funding to improve connectivity in underserved areas. For instance, the Federal Communications Commission (FCC) has introduced initiatives that encourage the deployment of fiber optic networks, which are essential for optical transport solutions. This funding not only supports the expansion of optical networks but also stimulates competition among service providers, leading to improved services and lower costs for consumers. As a result, the optical transport-network market will benefit from these governmental efforts.

Increased Focus on Network Security

As cyber threats become more sophisticated, the optical transport-network market is witnessing an increased focus on network security. Organizations are prioritizing secure data transmission to protect sensitive information from potential breaches. Optical transport networks offer inherent security advantages, such as encryption capabilities and reduced risk of signal interception. This heightened emphasis on security is prompting service providers to invest in advanced optical transport solutions that incorporate robust security features. Consequently, the optical transport-network market is likely to expand as businesses seek to enhance their network security while maintaining high-performance data transmission.