Growing Applications in Oncology

The optical genome-mapping market is significantly influenced by its growing applications in oncology. As cancer research progresses, the need for precise genomic information becomes paramount. Optical genome mapping provides detailed insights into structural variations in cancer genomes, aiding in the development of targeted therapies. The increasing prevalence of cancer in the US, with an estimated 1.9 million new cases expected in 2025, underscores the necessity for advanced genomic tools. This demand is likely to propel the optical genome-mapping market, as healthcare providers seek innovative solutions to enhance patient outcomes. The integration of optical genome mapping in clinical settings is anticipated to contribute to a market valuation exceeding $1.2 billion by 2026.

Rising Investment in Genomic Research

The optical genome-mapping market is benefiting from rising investment in genomic research across various sectors. Government and private funding initiatives are increasingly directed towards genomic studies, fostering innovation and development in this field. In the US, funding for genomic research has seen a notable increase, with federal agencies allocating over $1 billion annually to support various genomic projects. This influx of capital is likely to enhance the capabilities of optical genome mapping technologies, making them more accessible to researchers and clinicians. As a result, the market is expected to expand, with projections indicating a growth trajectory that could see it reach $1.4 billion by 2026. Such investments are crucial for advancing the optical genome-mapping market and its applications.

Emerging Collaborations and Partnerships

The optical genome-mapping market is witnessing a rise in collaborations and partnerships among key stakeholders. Academic institutions, biotechnology firms, and healthcare organizations are increasingly joining forces to advance genomic research and technology development. These collaborations often lead to the sharing of resources, expertise, and data, which can accelerate innovation in optical genome mapping. For instance, partnerships between universities and biotech companies have resulted in the development of novel mapping techniques that enhance resolution and accuracy. This trend is expected to foster a more dynamic market environment, with projections indicating a potential market size of $1.6 billion by 2026. Such collaborations are essential for driving the optical genome-mapping market forward.

Increased Focus on Personalized Medicine

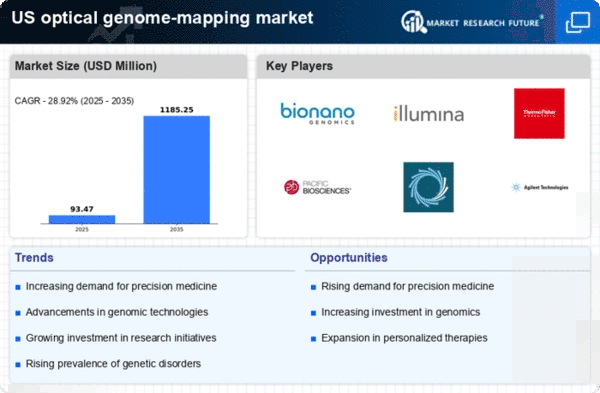

The optical genome-mapping market is poised for growth due to the increased focus on personalized medicine. As healthcare shifts towards tailored treatment approaches, the demand for precise genomic information is escalating. Optical genome mapping plays a critical role in identifying genetic variations that influence individual responses to therapies. This trend is particularly relevant in oncology and rare genetic disorders, where personalized treatment plans can significantly improve patient outcomes. The market is projected to grow at a CAGR of approximately 14%, potentially reaching $1.3 billion by 2026. The emphasis on personalized medicine is likely to drive the adoption of optical genome mapping technologies, thereby expanding the market's reach and impact.

Advancements in Genome Mapping Technologies

The optical genome-mapping market is experiencing a surge due to rapid advancements in genome mapping technologies. Innovations in imaging techniques and data analysis are enhancing the accuracy and efficiency of genome mapping. For instance, the introduction of high-resolution imaging systems has improved the ability to visualize complex genomic structures. This technological evolution is expected to drive market growth, as researchers and healthcare providers increasingly adopt these advanced tools for genetic analysis. The market was projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 15%. Such advancements not only facilitate research but also support clinical applications, thereby expanding the overall market landscape.