Increasing Allergy Prevalence

The nasal spray market experiences growth due to the rising prevalence of allergies among the population. According to recent data, approximately 30% of adults in the US suffer from allergic rhinitis, leading to a heightened demand for effective treatment options. Nasal sprays, particularly those containing antihistamines and corticosteroids, are increasingly favored for their rapid relief and ease of use. This trend indicates a shift towards self-medication, as consumers seek over-the-counter solutions for allergy management. The nasal spray market is thus positioned to benefit from this growing consumer base, as more individuals turn to these products for relief from seasonal and perennial allergies.

Shift Towards Self-Medication

The nasal spray market is witnessing a notable shift towards self-medication, driven by consumer preferences for accessible healthcare solutions. With the increasing availability of over-the-counter nasal sprays, patients are more inclined to manage their symptoms independently. This trend is particularly evident in the treatment of common conditions such as allergies and nasal congestion. The convenience of nasal sprays, combined with their effectiveness, has led to a surge in sales, with the market projected to reach $3 billion by 2026. The nasal spray market is adapting to this demand by expanding product lines and enhancing marketing strategies to attract self-medicating consumers.

Growing Awareness of Nasal Health

There is a growing awareness of nasal health among consumers, which is positively impacting the nasal spray market. Educational campaigns and health initiatives have highlighted the importance of maintaining nasal hygiene and addressing issues such as congestion and sinusitis. As a result, consumers are increasingly seeking nasal sprays that not only alleviate symptoms but also promote overall nasal health. This trend is reflected in the market, where products that combine therapeutic benefits with preventive care are gaining traction. The nasal spray market is responding by innovating formulations that cater to this heightened awareness, potentially expanding their consumer base.

Technological Innovations in Formulation

Technological innovations in formulation are driving advancements in the nasal spray market. Recent developments in drug delivery systems have enhanced the efficacy and user experience of nasal sprays. For instance, the introduction of metered-dose inhalers and novel delivery mechanisms has improved the precision of dosage and reduced side effects. These innovations are likely to attract both healthcare professionals and consumers, as they offer more reliable treatment options. The nasal spray market is thus positioned to capitalize on these technological advancements, potentially leading to increased market share and consumer trust in nasal spray products.

Rising Demand for Non-Prescription Options

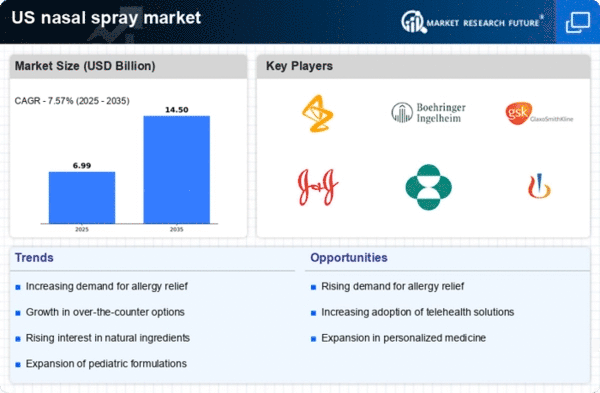

The nasal spray market is experiencing a rising demand for non-prescription options, as consumers increasingly prefer accessible healthcare solutions. This trend is fueled by the desire for convenience and the ability to manage symptoms without the need for a doctor's visit. Over-the-counter nasal sprays are becoming the go-to choice for many individuals dealing with allergies, colds, and sinus issues. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of 5% over the next five years. The nasal spray market is adapting to this trend by expanding its range of non-prescription products, catering to the evolving needs of consumers.