Growing Demand for Miniaturization

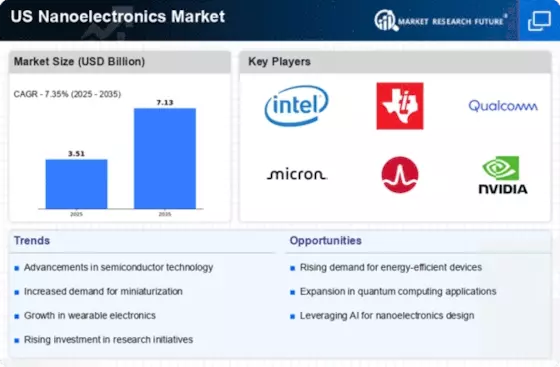

The US Nanoelectronics Market is experiencing a notable surge in demand for miniaturization across various sectors, including consumer electronics, automotive, and healthcare. As devices become increasingly compact, the need for nanoelectronic components that can deliver high performance in limited space is paramount. According to recent data, the market for nanoelectronics is projected to reach USD 100 billion by 2026, driven by innovations in semiconductor technology and the proliferation of Internet of Things (IoT) devices. This trend indicates a shift towards smaller, more efficient devices, which is likely to propel the growth of the US Nanoelectronics Market further. Companies are investing heavily in research and development to create advanced materials and manufacturing processes that support this miniaturization trend, thereby enhancing the overall market landscape.

Rising Consumer Electronics Market

The consumer electronics market in the US is witnessing robust growth, which is significantly influencing the US Nanoelectronics Market. With the increasing adoption of smart devices, wearables, and home automation systems, the demand for advanced nanoelectronic components is on the rise. Market analysts project that the consumer electronics sector will reach USD 400 billion by 2026, creating a substantial opportunity for nanoelectronics manufacturers. This growth is driven by consumer preferences for high-performance, energy-efficient devices that utilize nanoelectronic technologies. As manufacturers strive to meet these demands, the US Nanoelectronics Market is likely to expand, fostering innovation and competition among key players.

Regulatory Support and Policy Framework

The regulatory environment plays a pivotal role in shaping the US Nanoelectronics Market. Recent policies aimed at promoting semiconductor manufacturing and research have created a favorable landscape for growth. The CHIPS Act, for example, is designed to bolster domestic semiconductor production, which directly impacts the nanoelectronics sector. By providing financial incentives and support for manufacturing facilities, the government is encouraging companies to invest in nanoelectronics technologies. This regulatory support is likely to enhance the competitiveness of the US Nanoelectronics Market, as it fosters innovation and attracts foreign investment. Furthermore, a stable policy framework can lead to increased collaboration between academia and industry, driving further advancements in nanoelectronics.

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) with nanoelectronics is emerging as a transformative driver for the US Nanoelectronics Market. AI technologies require advanced processing capabilities, which nanoelectronic components can provide. As industries increasingly adopt AI solutions, the demand for high-performance nanoelectronics is expected to rise. This integration not only enhances the functionality of devices but also enables the development of smarter applications across various sectors, including healthcare, automotive, and telecommunications. The US Nanoelectronics Market is likely to see significant growth as companies leverage AI to optimize manufacturing processes and improve product performance. This synergy between AI and nanoelectronics could lead to innovative solutions that redefine market standards.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the US Nanoelectronics Market. The federal government, alongside private sector players, is allocating substantial resources to advance nanoelectronic technologies. For instance, the National Science Foundation has earmarked millions for projects aimed at enhancing nanoelectronics capabilities. This influx of funding is expected to foster innovation, leading to breakthroughs in areas such as quantum computing and advanced sensors. As a result, the US Nanoelectronics Market is likely to benefit from a robust pipeline of new products and technologies, which could enhance competitiveness on a global scale. The emphasis on R&D not only supports technological advancements but also creates a skilled workforce, further solidifying the industry's foundation.