The Mining Automation Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and a growing emphasis on operational efficiency. Key players such as Caterpillar Inc (US), Komatsu Ltd (US), and Sandvik AB (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Caterpillar Inc (US) focuses on innovation through the development of autonomous vehicles and advanced analytics, while Komatsu Ltd (US) emphasizes partnerships with technology firms to integrate AI into their mining solutions. Sandvik AB (US) is actively pursuing digital transformation initiatives, which include the deployment of cloud-based platforms to optimize mining operations. Collectively, these strategies not only enhance operational capabilities but also intensify competition within the market, as companies strive to differentiate themselves through technological prowess and service offerings.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and enhance supply chain resilience. This approach is particularly relevant in a moderately fragmented market where multiple players vie for market share. The competitive structure is influenced by the collective actions of these key players, who are leveraging their technological advancements to capture a larger portion of the market. Supply chain optimization remains a critical focus, as companies seek to mitigate risks and improve efficiency in their operations.

In December 2025, Caterpillar Inc (US) announced the launch of its new autonomous haulage system, which is designed to enhance safety and productivity in mining operations. This strategic move is significant as it positions Caterpillar as a leader in automation technology, potentially increasing its market share and reinforcing its reputation for innovation. The introduction of this system is expected to attract new clients seeking to modernize their operations and improve efficiency.

In November 2025, Komatsu Ltd (US) entered into a strategic partnership with a leading AI firm to develop predictive maintenance solutions for mining equipment. This collaboration is likely to enhance Komatsu's service offerings, allowing clients to minimize downtime and optimize equipment performance. By integrating AI into their solutions, Komatsu aims to provide a more comprehensive approach to mining automation, which could strengthen its competitive edge in the market.

In October 2025, Sandvik AB (US) unveiled its new cloud-based platform aimed at improving data analytics for mining operations. This platform is expected to facilitate real-time decision-making and enhance operational efficiency. The strategic importance of this development lies in Sandvik's commitment to digital transformation, which is increasingly becoming a key differentiator in the Mining Automation Market. By leveraging data analytics, Sandvik positions itself as a forward-thinking player capable of meeting the evolving needs of its clients.

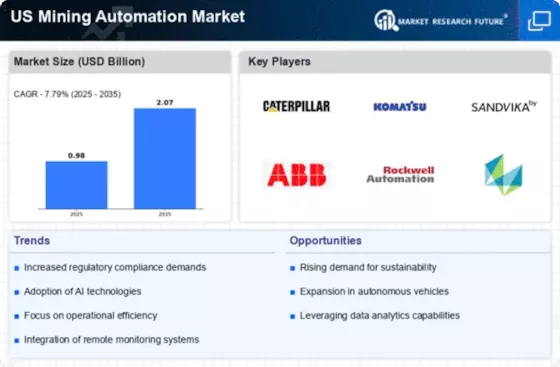

As of January 2026, the Mining Automation Market is witnessing trends that emphasize digitalization, sustainability, and AI integration. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and collaboration. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, as companies strive to differentiate themselves in an increasingly complex market. Looking ahead, competitive differentiation will likely evolve, with an emphasis on innovative solutions and sustainable practices becoming paramount.