Integration with Unmanned Systems

The integration of thermal imaging technology with unmanned systems is a significant driver in the military thermal-imaging market. Drones and unmanned ground vehicles equipped with thermal imaging sensors enhance situational awareness and operational efficiency. The US military has increasingly adopted these systems for intelligence, surveillance, and reconnaissance (ISR) missions. In 2025, it is projected that the market for unmanned aerial vehicles (UAVs) will reach $10 billion, with a substantial portion allocated to thermal imaging capabilities. This trend suggests that the military thermal-imaging market will continue to expand as unmanned systems become more prevalent in military operations.

Enhanced Surveillance Capabilities

The military thermal-imaging market is experiencing a surge in demand due to the increasing need for enhanced surveillance capabilities. As military operations become more complex, the ability to detect and identify targets in various environmental conditions is paramount. Thermal imaging technology provides superior night vision and can penetrate obscurants such as smoke and fog, making it invaluable for reconnaissance missions. In 2025, the US Department of Defense allocated approximately $2 billion for advanced imaging systems, indicating a strong commitment to upgrading surveillance technologies. This investment is expected to drive growth in the military thermal-imaging market, as military forces seek to maintain a tactical advantage in diverse operational theaters.

Demand for Enhanced Training Simulations

The military thermal-imaging market is also driven by the demand for enhanced training simulations. As military forces strive to improve readiness and effectiveness, realistic training environments that incorporate thermal imaging technology are becoming essential. These simulations allow personnel to familiarize themselves with thermal imaging systems and develop critical skills in target identification and engagement. In 2025, the US military is projected to invest over $500 million in training technologies, including thermal imaging systems. This investment underscores the importance of integrating advanced technologies into training programs, thereby fostering growth in the military thermal-imaging market.

Rising Threats and Geopolitical Tensions

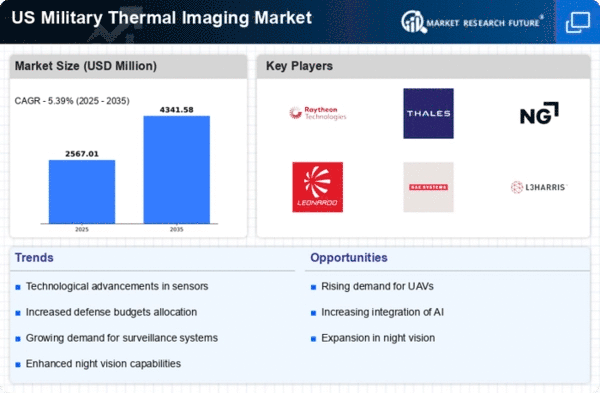

The military thermal-imaging market is significantly influenced by rising threats and geopolitical tensions. As nations face increased security challenges, there is a heightened focus on modernizing military capabilities. The US military has recognized the necessity of advanced thermal imaging systems to counteract evolving threats, particularly in asymmetric warfare scenarios. In 2025, defense budgets are expected to reflect a 5% increase, with a notable portion directed towards enhancing thermal imaging technologies. This trend indicates a robust growth trajectory for the military thermal-imaging market as defense forces prioritize advanced surveillance and targeting solutions.

Focus on Miniaturization and Cost Reduction

The military thermal-imaging market is witnessing a focus on miniaturization and cost reduction of thermal imaging systems. As technology advances, manufacturers are developing smaller, lighter, and more affordable thermal imaging devices without compromising performance. This trend is particularly relevant for infantry units that require portable and efficient equipment. In 2025, the market for compact thermal imaging systems is expected to grow by 15%, driven by the need for versatile solutions in various military applications. This emphasis on miniaturization and cost-effectiveness is likely to enhance the accessibility of thermal imaging technology, further propelling the military thermal-imaging market.