Customization Demand

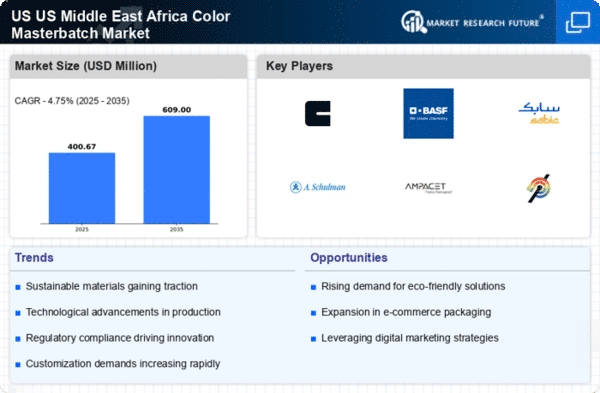

Customization is emerging as a key driver in the US Color Masterbatch Market. As industries such as packaging, automotive, and consumer goods evolve, the need for tailored color solutions has become paramount. In 2025, approximately 40% of color masterbatch sales in the US were attributed to customized products, reflecting a shift towards personalized manufacturing. This trend is fueled by the desire for unique branding and differentiation in a crowded marketplace. Manufacturers are responding by offering a wider range of color options, effects, and formulations that meet specific customer requirements. The ability to provide bespoke solutions not only enhances customer satisfaction but also fosters long-term partnerships between suppliers and clients. As the market continues to grow, the emphasis on customization is likely to intensify, driving innovation and expanding the scope of applications for color masterbatches.

Regulatory Compliance

Regulatory compliance is a critical factor influencing the US Color Masterbatch Market. With increasing scrutiny on product safety and environmental impact, manufacturers are compelled to adhere to stringent regulations set forth by agencies such as the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA). In 2025, compliance-related costs accounted for nearly 15% of operational expenses for color masterbatch producers in the US. This necessitates ongoing investment in quality control and testing to ensure that products meet safety standards. As regulations evolve, particularly concerning the use of hazardous substances and recyclability, companies that proactively adapt to these changes are likely to gain a competitive edge. The focus on compliance not only mitigates risks but also enhances the overall credibility of the US Color Masterbatch Market.

Technological Innovations

Technological advancements play a pivotal role in shaping the US Color Masterbatch Market. The integration of advanced manufacturing techniques, such as digital printing and precision color matching, has revolutionized the way color masterbatches are produced and applied. In 2025, the market witnessed a surge in demand for high-performance masterbatches that offer superior color consistency and stability. Innovations in polymer technology have enabled manufacturers to create masterbatches that are not only vibrant but also durable under various environmental conditions. This technological evolution is expected to continue, with investments in research and development likely to yield new products that cater to specific industry needs, such as automotive and packaging. As a result, the competitive landscape of the US Color Masterbatch Market is becoming increasingly dynamic, with companies striving to differentiate themselves through cutting-edge solutions.

Sustainability Initiatives

The US Color Masterbatch Market is increasingly influenced by sustainability initiatives. As consumers and manufacturers alike prioritize eco-friendly practices, the demand for sustainable color masterbatches is on the rise. Companies are investing in bio-based and recyclable materials to meet regulatory standards and consumer expectations. In 2025, the market for sustainable color masterbatches in the US was estimated to account for approximately 30% of the total market share, reflecting a growing trend towards environmentally responsible production. This shift not only enhances brand reputation but also aligns with the broader goals of reducing carbon footprints and promoting circular economy principles. As regulations tighten, the industry is likely to see further innovations in sustainable formulations, which could reshape product offerings and market dynamics.

Market Expansion Opportunities

Market expansion opportunities are increasingly prevalent within the US Color Masterbatch Market. The growth of end-use sectors such as packaging, automotive, and construction is driving demand for color masterbatches. In 2025, the packaging sector alone represented over 50% of the total market share, highlighting its significance. As manufacturers seek to enhance product aesthetics and functionality, the need for innovative color solutions is expected to rise. Additionally, the trend towards lightweight materials in automotive applications is likely to spur demand for specialized masterbatches that cater to these requirements. Companies that strategically position themselves to capitalize on these growth areas may find lucrative opportunities for expansion. The potential for collaboration with emerging industries, such as bioplastics and smart materials, further underscores the dynamic nature of the US Color Masterbatch Market.