Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in the US is a significant driver for the metabolomics services market. Conditions such as diabetes, cardiovascular diseases, and cancer are becoming more prevalent, necessitating advanced diagnostic and therapeutic approaches. Metabolomics offers a unique perspective on disease mechanisms, allowing for the identification of metabolic biomarkers that can aid in early diagnosis and personalized treatment strategies. According to recent statistics, chronic diseases account for approximately 70% of all deaths in the US, highlighting the urgent need for effective management solutions. This growing health crisis is likely to stimulate demand for metabolomics services, as healthcare providers seek innovative ways to improve patient outcomes. the market is expected to expand as healthcare systems increasingly adopt metabolomics to enhance disease management and treatment efficacy.

Growing Investment in Research and Development

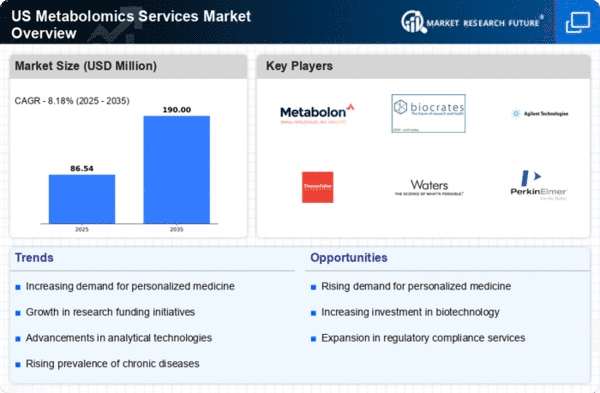

The metabolomics services market is experiencing a surge in investment, particularly in research and development (R&D) initiatives. This trend is driven by the increasing recognition of metabolomics as a critical tool in drug discovery, biomarker identification, and disease understanding. In the US, funding from both public and private sectors has escalated, with R&D expenditures in the life sciences reaching approximately $200 billion annually. This influx of capital is likely to enhance the capabilities of metabolomics services, enabling more sophisticated analyses and applications. As a result, the market is poised for growth, with an expected CAGR of around 12% over the next five years. The focus on innovative methodologies and technologies in R&D is expected to propel the metabolomics services market forward, fostering advancements that could lead to breakthroughs in various health-related fields.

Advancements in Data Analysis and Bioinformatics

The metabolomics services market is being significantly influenced by advancements in data analysis and bioinformatics. As the volume of data generated from metabolomic studies increases, the need for sophisticated analytical tools becomes paramount. Innovations in machine learning and artificial intelligence are enabling researchers to extract meaningful insights from complex datasets, thereby enhancing the utility of metabolomics in various applications. In the US, the bioinformatics market is projected to reach $10 billion by 2026, indicating a robust growth trajectory that will likely benefit the metabolomics services market. These advancements not only improve the accuracy of metabolomic analyses but also facilitate the integration of metabolomics with other omics technologies, creating a more comprehensive understanding of biological systems. Consequently, the market is expected to thrive as these technologies become more accessible and user-friendly.

Regulatory Support for Metabolomics Applications

Regulatory bodies in the US are increasingly recognizing the potential of metabolomics in various applications, including drug development and clinical diagnostics. This regulatory support is fostering an environment conducive to the growth of the metabolomics services market. Initiatives aimed at streamlining the approval processes for metabolomic-based products and services are being implemented, which may enhance market accessibility. For instance, the FDA has shown interest in incorporating metabolomic data into its regulatory frameworks, potentially expediting the approval of new therapies. This supportive regulatory landscape is likely to encourage investment and innovation within the metabolomics services market, as companies seek to leverage these opportunities. As regulations evolve, the market could witness a surge in the adoption of metabolomics technologies across different sectors, further driving growth.

Rising Awareness of Metabolomics in Clinical Research

There is a growing awareness of the role of metabolomics in clinical research, which is significantly impacting the metabolomics services market. Researchers and clinicians are increasingly recognizing the value of metabolomic profiling in understanding disease mechanisms and developing targeted therapies. Educational initiatives and conferences are promoting the benefits of metabolomics, leading to a broader acceptance of its applications in clinical settings. In the US, the number of publications related to metabolomics has increased by over 30% in recent years, reflecting the expanding interest in this field. This heightened awareness is likely to drive demand for metabolomics services, as more institutions seek to incorporate these analyses into their research protocols. As the understanding of metabolomics continues to evolve, the market is expected to grow, with an increasing number of collaborations between academic institutions and service providers.