Cost Reduction Pressures in Healthcare

Cost reduction pressures are a driving force behind the expansion of the medical automation market. Healthcare providers are facing mounting financial challenges, necessitating the adoption of cost-effective solutions. Automation technologies can significantly lower operational costs by streamlining processes and reducing the need for manual labor. For instance, automated billing and coding systems can decrease administrative costs by up to 25%. As healthcare organizations seek to maintain profitability while delivering high-quality care, the medical automation market is poised for growth, as these technologies offer viable solutions to address financial constraints.

Rising Demand for Efficiency in Healthcare

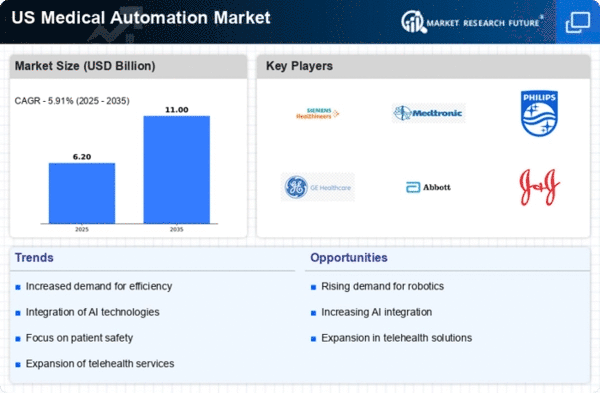

The medical automation market is experiencing a notable surge in demand for efficiency within healthcare settings. As healthcare providers strive to enhance operational workflows, automation technologies are increasingly being adopted. This trend is driven by the need to reduce human error and improve patient outcomes. According to recent data, the automation of routine tasks can lead to a reduction in operational costs by up to 30%. Consequently, healthcare facilities are investing in automated systems to streamline processes, thereby allowing medical professionals to focus on patient care. This shift towards automation is likely to continue, as the medical automation market evolves to meet the growing expectations of both providers and patients.

Technological Advancements in Medical Devices

Technological advancements are playing a pivotal role in shaping the medical automation market. Innovations in medical devices, such as automated diagnostic tools and robotic surgical systems, are enhancing the precision and efficiency of medical procedures. For instance, the integration of advanced imaging technologies has improved diagnostic accuracy, which is crucial for effective treatment planning. The market for automated medical devices is projected to grow significantly, with estimates suggesting an increase of over 20% in the next five years. This growth is indicative of the increasing reliance on technology to improve healthcare delivery and patient safety, further propelling the medical automation market.

Regulatory Support for Automation Technologies

Regulatory support is emerging as a key driver for the medical automation market. Government agencies are increasingly recognizing the potential of automation technologies to improve healthcare delivery. Initiatives aimed at promoting the adoption of automated systems are being implemented, which may include funding for research and development. Furthermore, streamlined approval processes for automated medical devices are likely to encourage innovation and expedite market entry. This supportive regulatory environment is expected to foster growth in the medical automation market, as companies are incentivized to develop and deploy new technologies that enhance patient care and operational efficiency.

Aging Population and Increased Chronic Diseases

The aging population in the United States is contributing significantly to the growth of the medical automation market. As the demographic shifts towards an older population, there is a corresponding rise in chronic diseases that require ongoing management. Automation technologies are being utilized to monitor patient health and manage chronic conditions more effectively. For example, automated monitoring systems can track vital signs and alert healthcare providers to potential issues, thereby improving patient outcomes. This trend is likely to continue, as the demand for efficient healthcare solutions grows in response to the increasing prevalence of chronic diseases among the aging population.