Increased Recreational Boating Activities

The market is experiencing growth due to a surge in recreational boating activities across the United States. As more individuals engage in boating for leisure, the demand for advanced marine electronics, such as GPS systems, fish finders, and communication devices, is likely to rise. According to industry reports, the recreational boating sector has seen a growth rate of approximately 5% annually, which directly influences the marine electronics market. This trend is further supported by the increasing disposable income of consumers, allowing for greater investment in high-quality marine electronics. As boating becomes a more popular pastime, the marine electronics market is expected to expand, catering to the needs of both novice and experienced boaters seeking enhanced navigation and safety features.

Regulatory Compliance and Safety Standards

The marine electronics market is significantly impacted by stringent regulatory compliance and safety standards imposed by government agencies in the United States. These regulations often mandate the installation of specific electronic systems on vessels, such as Automatic Identification Systems (AIS) and VHF radios, to ensure safety and communication at sea. The enforcement of these regulations has led to an increased demand for reliable and advanced marine electronics. As the industry adapts to these requirements, manufacturers are innovating to provide compliant solutions, which may drive market growth. The market is likely to benefit from this trend. Boat owners prioritize safety and compliance, which leads to increased sales of essential electronic equipment.

Growing Demand for Integrated Marine Solutions

The market is increasingly influenced by the growing demand for integrated marine solutions. These solutions combine multiple functionalities into a single system. Boat owners are seeking devices that offer seamless integration of navigation, communication, and entertainment features. This trend is particularly evident in the rise of multifunction displays that provide comprehensive information at a glance. As consumers prioritize convenience and efficiency, manufacturers are responding by developing all-in-one solutions that cater to these needs. The marine electronics market is likely to see a surge in sales of integrated systems, as they offer enhanced user experiences and streamline operations on board.

Technological Innovations in Navigation Systems

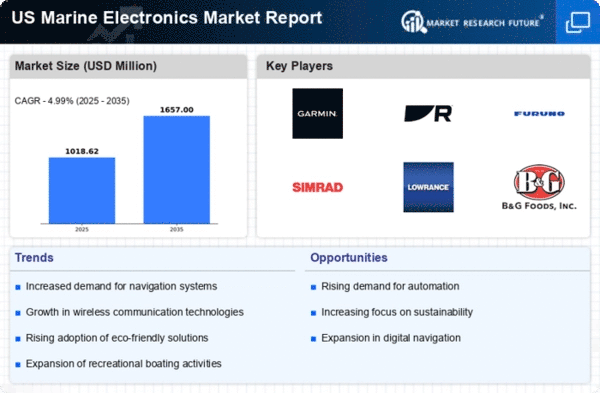

The marine electronics market is witnessing a transformation driven by technological innovations in navigation systems. Advanced technologies, such as satellite-based navigation and integrated chartplotters, are enhancing the accuracy and efficiency of marine navigation. The introduction of features like real-time weather updates and automated route planning is appealing to both commercial and recreational boaters. As these technologies become more accessible, the marine electronics market is expected to grow, with a projected increase in sales of navigation devices by approximately 7% annually. This trend indicates a shift towards smarter, more efficient navigation solutions, which could redefine the standards of marine travel and safety.

Expansion of Commercial Shipping and Fishing Industries

The market is benefiting from the expansion of the commercial shipping and fishing industries in the United States. As these sectors grow, there is an increasing need for advanced electronic systems that enhance operational efficiency and safety. Technologies such as sonar systems, radar, and electronic logbooks are becoming essential tools for commercial vessels. The fishing industry, in particular, is projected to grow at a rate of 4% annually, driving demand for specialized marine electronics. This expansion indicates a robust market opportunity for manufacturers to innovate and provide tailored solutions that meet the specific needs of commercial operators, thereby contributing to the overall growth of the marine electronics market.