Rising Cyber Threat Landscape

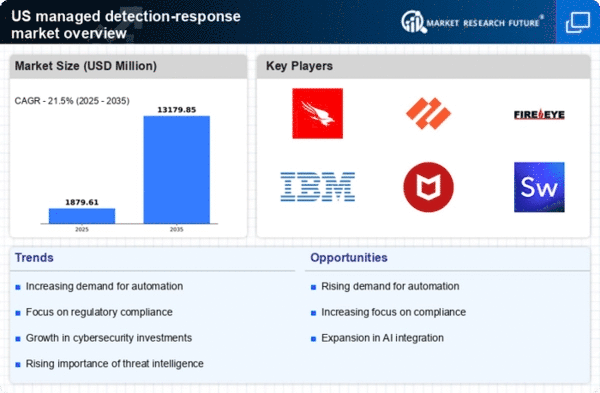

The managed detection-response market is experiencing growth due to the escalating cyber threat landscape in the US. Organizations are increasingly targeted by sophisticated cyber attacks, which have surged by approximately 30% in recent years. This alarming trend compels businesses to adopt advanced security measures, including managed detection-response services. As cybercriminals employ more complex tactics, the demand for real-time threat detection and response capabilities intensifies. Companies recognize that traditional security measures are insufficient, leading to a shift towards managed detection-response solutions. The market is projected to reach $5 billion by 2026, reflecting a compound annual growth rate (CAGR) of 15%. This growth underscores the critical need for organizations to enhance their cybersecurity posture through managed detection-response services.

Growing Regulatory Requirements

The managed detection-response market is significantly influenced by the growing regulatory requirements in the US. With the implementation of stringent data protection laws, such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA), organizations are compelled to enhance their cybersecurity measures. Compliance with these regulations necessitates robust monitoring and incident response capabilities, which are core components of managed detection-response services. As businesses strive to avoid hefty fines and reputational damage, the demand for these services is expected to rise. The managed detection-response market is likely to see an increase in adoption rates as organizations prioritize compliance and risk management, further driving market growth.

Shift Towards Cloud-Based Solutions

The managed detection-response market is witnessing a shift towards cloud-based solutions, which is reshaping the landscape of cybersecurity. As organizations increasingly migrate their operations to the cloud, the need for effective security measures becomes paramount. Cloud environments present unique challenges, including the need for continuous monitoring and rapid response to threats. Managed detection-response services offer scalable solutions that align with the dynamic nature of cloud computing. This trend is expected to drive market growth, as businesses seek to leverage the flexibility and efficiency of cloud-based security solutions. The managed detection-response market is projected to expand as organizations recognize the importance of integrating these services into their cloud strategies.

Increased Investment in Cybersecurity

Investment in cybersecurity is a significant driver for the managed detection-response market. In the US, organizations are allocating larger portions of their IT budgets to cybersecurity, with estimates indicating that spending could exceed $200 billion by 2025. This trend is fueled by the recognition of cybersecurity as a business imperative rather than a mere IT concern. As companies face mounting pressure to protect sensitive data and maintain customer trust, they are turning to managed detection-response services to bolster their defenses. The managed detection-response market is poised to benefit from this increased investment, as organizations seek comprehensive solutions that provide continuous monitoring and rapid incident response. This shift in funding priorities is likely to sustain market growth in the coming years.

Emergence of Advanced Threat Detection Technologies

The emergence of advanced threat detection technologies is a pivotal driver for the managed detection-response market. Innovations in artificial intelligence (AI) and machine learning (ML) are enhancing the capabilities of threat detection and response. These technologies enable organizations to identify and mitigate threats more effectively, reducing response times and minimizing potential damage. As the sophistication of cyber threats evolves, the managed detection-response market is likely to benefit from the adoption of these advanced technologies. Organizations are increasingly seeking solutions that incorporate AI and ML to improve their security posture. This trend suggests a promising future for the managed detection-response market, as businesses prioritize cutting-edge technologies to combat emerging threats.