Expansion of Smart Infrastructure

The expansion of smart infrastructure initiatives is significantly influencing the iot analytics market. As cities and organizations invest in smart technologies, the volume of data generated by connected devices is surging. This influx of data necessitates sophisticated analytics solutions to derive actionable insights. For instance, smart cities are leveraging IoT analytics to optimize traffic management and energy consumption. The market for smart infrastructure is expected to grow at a CAGR of 25% over the next five years, highlighting the increasing reliance on IoT analytics for urban planning and resource management. This trend illustrates how the development of smart infrastructure is propelling the demand for advanced analytics capabilities within the iot analytics market.

Rising Demand for Real-Time Insights

The increasing need for real-time data analysis is driving the growth of the iot analytics market. Businesses across various sectors are recognizing the value of immediate insights derived from IoT devices. This demand is particularly evident in industries such as manufacturing and logistics, where timely data can enhance operational efficiency. According to recent estimates, the market for real-time analytics is projected to reach $20 billion by 2026, indicating a robust growth trajectory. Companies are investing in advanced analytics solutions to harness the power of IoT data, thereby improving decision-making processes and operational agility. This trend underscores the critical role of real-time insights in the evolving landscape of the iot analytics market.

Growing Focus on Predictive Maintenance

The growing emphasis on predictive maintenance is a key driver for the iot analytics market. Organizations are increasingly adopting IoT solutions to monitor equipment health and predict failures before they occur. This proactive approach not only reduces downtime but also minimizes maintenance costs. Industries such as manufacturing and transportation are particularly benefiting from predictive maintenance strategies, with estimates suggesting that predictive maintenance can reduce maintenance costs by up to 30%. As companies seek to enhance operational efficiency and reduce unexpected failures, the demand for IoT analytics solutions that support predictive maintenance is likely to rise. This trend is reshaping the landscape of the iot analytics market.

Increased Investment in IoT Technologies

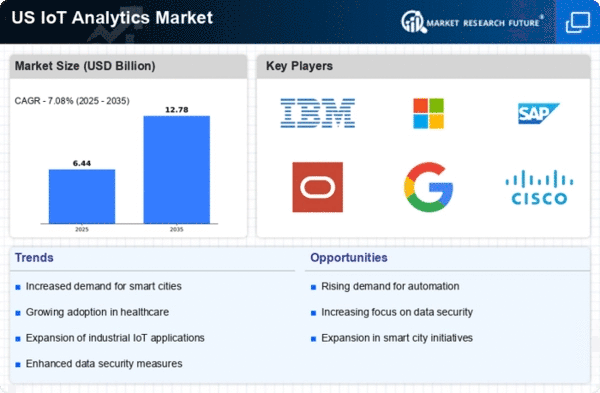

The surge in investment in IoT technologies is a significant catalyst for the iot analytics market. Venture capital and corporate investments in IoT startups and solutions have reached unprecedented levels, with funding exceeding $10 billion in 2025 alone. This influx of capital is fostering innovation and the development of advanced analytics tools that can process and analyze vast amounts of IoT data. As organizations recognize the strategic importance of IoT analytics in driving business outcomes, they are allocating more resources to these technologies. This trend indicates a robust growth potential for the iot analytics market as new solutions emerge to meet the evolving needs of businesses.

Regulatory Compliance and Data Governance

The increasing focus on regulatory compliance and data governance is shaping the iot analytics market. Organizations are under pressure to adhere to stringent data protection regulations, which necessitates the implementation of robust analytics solutions. Compliance with regulations such as the CCPA and GDPR requires businesses to ensure that their data practices are transparent and secure. As a result, companies are investing in IoT analytics tools that not only provide insights but also facilitate compliance with these regulations. This trend is likely to drive the demand for analytics solutions that prioritize data governance, thereby influencing the overall growth of the iot analytics market.