Technological Advancements

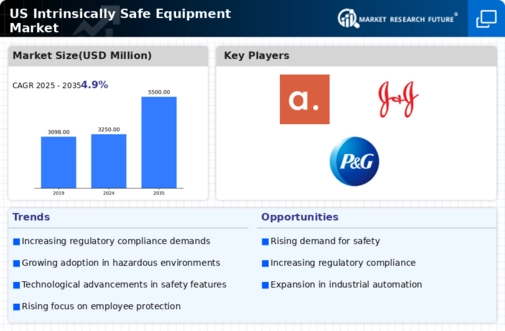

Technological advancements play a pivotal role in shaping the US Intrinsically Safe Equipment Market. Innovations in sensor technology, wireless communication, and battery efficiency have led to the development of more sophisticated intrinsically safe devices. These advancements not only improve operational efficiency but also enhance safety in hazardous environments. For instance, the integration of IoT capabilities in intrinsically safe equipment allows for real-time monitoring and data analytics, which can significantly reduce the risk of accidents. The market is expected to witness a compound annual growth rate (CAGR) of approximately 6% as companies increasingly invest in advanced technologies to meet safety requirements.

Growing Demand in Key Industries

The US Intrinsically Safe Equipment Market is experiencing a surge in demand from key sectors such as oil and gas, pharmaceuticals, and chemical processing. These industries are characterized by their exposure to hazardous conditions, necessitating the use of intrinsically safe equipment to ensure worker safety and operational continuity. The oil and gas sector, in particular, is projected to account for over 40% of the market share by 2026, driven by ongoing exploration and production activities. This growing demand is further fueled by the increasing focus on safety and risk management, prompting companies to invest in reliable intrinsically safe solutions.

Increased Awareness of Workplace Safety

Increased awareness of workplace safety is a crucial driver for the US Intrinsically Safe Equipment Market. As organizations prioritize employee safety and well-being, there is a growing recognition of the importance of using intrinsically safe equipment in hazardous environments. Training programs and safety campaigns have heightened awareness among workers and management alike, leading to a cultural shift towards safety-first practices. This trend is likely to propel market growth, as companies seek to comply with safety regulations and protect their workforce. The market is anticipated to expand by approximately 4% annually as organizations increasingly adopt safety measures.

Economic Growth and Industrial Expansion

Economic growth and industrial expansion in the United States are significant factors driving the US Intrinsically Safe Equipment Market. As the economy continues to recover and expand, industries such as construction, manufacturing, and energy are witnessing increased activity. This growth necessitates the use of intrinsically safe equipment to ensure safety in potentially explosive environments. The construction sector, for instance, is expected to see a rise in projects that require compliance with safety standards, thereby boosting demand for intrinsically safe solutions. The market is projected to grow at a rate of 5% annually, reflecting the positive correlation between economic activity and the need for safety equipment.

Regulatory Compliance and Safety Standards

The US Intrinsically Safe Equipment Market is significantly influenced by stringent regulatory compliance and safety standards. Regulatory bodies such as the Occupational Safety and Health Administration (OSHA) and the National Fire Protection Association (NFPA) enforce guidelines that mandate the use of intrinsically safe equipment in hazardous environments. This regulatory landscape compels industries such as oil and gas, chemical manufacturing, and mining to adopt intrinsically safe technologies to mitigate risks associated with explosive atmospheres. As a result, the market is projected to grow, with an estimated increase of 5% annually over the next five years, driven by the need for compliance and enhanced safety measures.