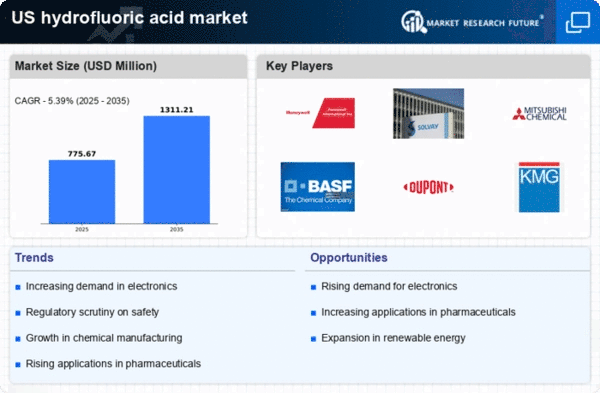

The hydrofluoric acid market exhibits a competitive landscape characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for fluorinated compounds in various applications, such as electronics and pharmaceuticals. Major companies like Honeywell International Inc. (US), DuPont de Nemours, Inc. (US), and BASF SE (DE) are strategically positioned to leverage their extensive research and development capabilities. Honeywell, for instance, focuses on innovation in sustainable production methods, while DuPont emphasizes its commitment to safety and environmental stewardship. These strategies collectively shape a competitive environment that is increasingly focused on sustainability and technological advancement.In terms of business tactics, companies are localizing manufacturing to enhance supply chain efficiency and reduce costs. The market structure appears moderately fragmented, with several key players holding substantial market shares. This fragmentation allows for a diverse range of products and services, fostering competition that drives innovation. The collective influence of these companies is significant, as they continuously adapt to market demands and regulatory changes, ensuring their relevance in a rapidly evolving landscape.

In October DuPont de Nemours, Inc. (US) announced a partnership with a leading technology firm to develop advanced hydrofluoric acid production techniques aimed at reducing carbon emissions. This strategic move underscores DuPont's commitment to sustainability and positions the company as a leader in environmentally friendly practices within the industry. The collaboration is expected to enhance operational efficiency and align with global sustainability goals, potentially setting a new standard for production methods.

In September BASF SE (DE) expanded its hydrofluoric acid production capacity in North America, responding to the growing demand from the semiconductor industry. This expansion not only strengthens BASF's market position but also reflects a broader trend of increasing investment in domestic manufacturing capabilities. The strategic importance of this move lies in its potential to secure supply chains and meet the rising needs of high-tech applications, thereby enhancing BASF's competitive edge.

In November Honeywell International Inc. (US) launched a new line of hydrofluoric acid products designed for the electronics sector, emphasizing enhanced purity and performance. This product launch is indicative of Honeywell's focus on innovation and its ability to respond to specific market needs. By catering to the high standards required in electronics manufacturing, Honeywell is likely to strengthen its market share and reinforce its reputation as a leader in the sector.

As of November current competitive trends in the hydrofluoric acid market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing operational efficiencies. Looking ahead, competitive differentiation is expected to evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition may redefine market dynamics, compelling companies to invest in research and development to maintain their competitive positions.