Growing Industrialization

The ongoing trend of industrialization in the United States is significantly influencing the US High Integrity Pressure Protection System Hipps Market. As manufacturing and processing sectors expand, the need for effective pressure protection systems becomes increasingly critical. Industries such as petrochemicals, pharmaceuticals, and food processing are experiencing growth, necessitating the implementation of HIPPS to manage pressure-related risks. The US government has also been promoting initiatives to enhance industrial safety, further driving the demand for advanced pressure protection solutions. Market analysts estimate that the industrial sector's expansion could lead to a 5% increase in HIPPS adoption over the next few years. This growth reflects the interdependence between industrialization and the need for reliable safety systems in the US High Integrity Pressure Protection System Hipps Market.

Technological Advancements

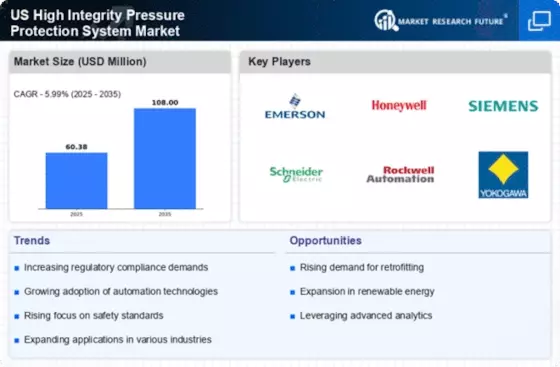

Technological advancements play a pivotal role in the evolution of the US High Integrity Pressure Protection System Hipps Market. Innovations in sensor technology, control systems, and data analytics have significantly enhanced the performance and reliability of HIPPS. For instance, the integration of smart sensors allows for real-time monitoring and predictive maintenance, reducing the likelihood of system failures. Furthermore, advancements in software algorithms enable better decision-making processes, optimizing the overall efficiency of pressure protection systems. As industries increasingly adopt these cutting-edge technologies, the market is expected to witness substantial growth. The introduction of Industry 4.0 concepts, including the Internet of Things (IoT), is likely to further propel the demand for advanced HIPPS solutions, with market analysts projecting a compound annual growth rate (CAGR) of 7% through 2028.

Increased Regulatory Compliance

The US High Integrity Pressure Protection System Hipps Market is experiencing a surge in demand due to heightened regulatory compliance requirements. Regulatory bodies, such as the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA), have established stringent guidelines to ensure safety in industrial operations. These regulations necessitate the implementation of advanced pressure protection systems to mitigate risks associated with overpressure scenarios. As a result, companies are increasingly investing in HIPPS to comply with these regulations, thereby driving market growth. The market is projected to expand as industries recognize the importance of adhering to safety standards, with an estimated growth rate of 6% annually over the next five years. This trend underscores the critical role of regulatory compliance in shaping the US High Integrity Pressure Protection System Hipps Market.

Focus on Safety and Risk Mitigation

The emphasis on safety and risk mitigation is a driving force in the US High Integrity Pressure Protection System Hipps Market. Industries such as oil and gas, chemical processing, and power generation are prioritizing the implementation of HIPPS to safeguard personnel and assets from potential hazards. The increasing frequency of industrial accidents has heightened awareness regarding the necessity of robust pressure protection systems. Consequently, organizations are investing in HIPPS as a proactive measure to prevent catastrophic failures. This focus on safety is reflected in the market's growth trajectory, with a projected increase in demand for HIPPS solutions by approximately 8% over the next few years. The commitment to enhancing safety standards is likely to remain a key driver in shaping the future landscape of the US High Integrity Pressure Protection System Hipps Market.

Rising Investment in Infrastructure

Rising investment in infrastructure development is a notable driver of the US High Integrity Pressure Protection System Hipps Market. The US government has allocated substantial funds for infrastructure projects, including energy, transportation, and utilities. These projects often require the installation of advanced safety systems, including HIPPS, to ensure operational integrity and safety. As infrastructure projects progress, the demand for reliable pressure protection systems is expected to increase. The market is likely to benefit from this trend, with projections indicating a potential growth rate of 4% in HIPPS adoption as infrastructure investments continue to rise. This correlation between infrastructure development and the US High Integrity Pressure Protection System Hipps Market underscores the importance of safety in large-scale projects.