Expansion of End-User Industries

The US Glass Flake Coatings Market is witnessing expansion driven by the growth of end-user industries such as automotive, aerospace, and construction. These sectors are increasingly recognizing the benefits of glass flake coatings, including their superior barrier properties and resistance to chemicals and abrasion. As these industries evolve, the demand for high-performance coatings that can enhance product durability and performance is on the rise. For instance, the automotive sector is focusing on lightweight materials and coatings that can withstand extreme conditions, thereby boosting the adoption of glass flake coatings. Market analysts project that the expansion of these end-user industries could lead to a market growth rate of 8% over the next few years, highlighting the potential for glass flake coatings to play a pivotal role in various applications.

Advancements in Coating Technologies

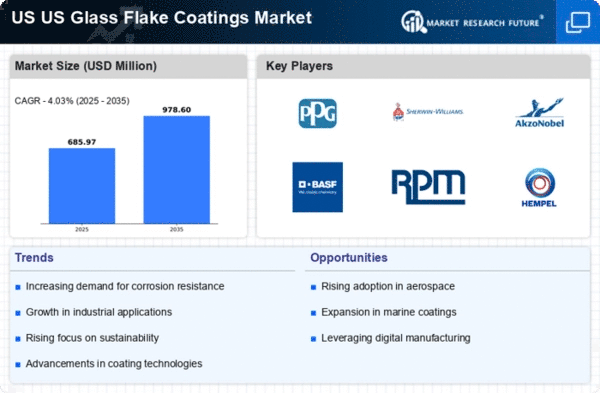

Technological advancements in coating formulations and application methods are significantly influencing the US Glass Flake Coatings Market. Innovations such as improved resin systems and application techniques have enhanced the performance characteristics of glass flake coatings, making them more effective in various applications. These advancements not only improve the protective qualities of the coatings but also facilitate easier application processes, thereby reducing labor costs and time. The introduction of eco-friendly formulations is also gaining traction, aligning with the growing emphasis on sustainability in the coatings industry. As manufacturers continue to invest in research and development, the market is expected to witness a surge in the adoption of advanced glass flake coatings, potentially leading to a market growth rate of 6% annually over the next five years.

Growth in Infrastructure Development

The US Glass Flake Coatings Market is poised to benefit from the ongoing growth in infrastructure development across the country. With significant investments being made in transportation, energy, and public works, there is an increasing need for durable and long-lasting coatings that can withstand the rigors of heavy use and environmental exposure. Glass flake coatings are particularly well-suited for this purpose, offering exceptional durability and resistance to wear and tear. The US government has allocated substantial funding for infrastructure projects, which is expected to drive demand for high-performance coatings. As a result, the market for glass flake coatings is likely to expand, with projections indicating a potential increase in market size by 10% over the next few years, reflecting the critical role these coatings play in enhancing the lifespan of infrastructure.

Rising Demand for Corrosion Resistance

The US Glass Flake Coatings Market is experiencing a notable increase in demand for corrosion-resistant coatings, particularly in sectors such as marine, oil and gas, and industrial applications. This demand is driven by the need to protect assets from harsh environmental conditions and corrosive substances. Glass flake coatings provide superior barrier properties, which significantly enhance the longevity of structures and equipment. According to industry reports, the market for corrosion-resistant coatings in the US is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. This growth is indicative of a broader trend towards investing in protective solutions that ensure operational efficiency and reduce maintenance costs, thereby solidifying the position of glass flake coatings as a preferred choice in various industries.

Increased Focus on Environmental Regulations

The US Glass Flake Coatings Market is increasingly influenced by stringent environmental regulations aimed at reducing volatile organic compounds (VOCs) and promoting sustainable practices. Regulatory bodies are enforcing guidelines that necessitate the use of low-emission coatings, which has led to a shift towards glass flake coatings known for their minimal environmental impact. These coatings not only comply with regulations but also offer enhanced performance characteristics, making them an attractive option for manufacturers. The growing awareness of environmental sustainability among consumers and businesses is further propelling the demand for eco-friendly coatings. As a result, the market for glass flake coatings is expected to expand, with estimates suggesting a growth of approximately 7% in the coming years as companies seek compliant and sustainable solutions.