Growth of E-commerce and Retail

The ongoing growth of e-commerce and retail sectors is significantly influencing the geofencing market. As online shopping continues to gain traction, retailers are increasingly adopting geofencing technology to bridge the gap between online and offline shopping experiences. In 2025, e-commerce sales in the US are expected to surpass $1 trillion, prompting retailers to implement geofencing strategies to attract customers to physical stores. By sending location-based notifications and offers, businesses can drive foot traffic and enhance in-store sales. This trend highlights the importance of integrating geofencing solutions into retail strategies, as companies aim to create seamless shopping experiences that cater to the evolving preferences of consumers in the geofencing market.

Advancements in Mobile Technology

The rapid advancements in mobile technology are playing a crucial role in shaping the geofencing market. With the proliferation of smartphones and mobile applications, businesses are increasingly utilizing geofencing capabilities to engage customers effectively. As of 2025, it is projected that over 80% of the US population will own a smartphone, providing a vast audience for geofencing applications. This technological evolution enables companies to create more interactive and immersive experiences for users, thereby enhancing customer loyalty and retention. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) with geofencing solutions is likely to create new opportunities for businesses to innovate their marketing strategies within the geofencing market.

Increased Focus on Customer Experience

The geofencing market is witnessing an increased focus on enhancing customer experience. Businesses are recognizing that providing personalized and relevant interactions can significantly impact customer satisfaction and loyalty. In 2025, it is anticipated that companies investing in customer experience initiatives will see a 20% increase in customer retention rates. By leveraging geofencing technology, businesses can deliver timely and contextually relevant messages to customers based on their location. This approach not only improves engagement but also fosters a sense of connection between the brand and the consumer. As organizations prioritize customer-centric strategies, the geofencing market is likely to evolve to meet these demands.

Rising Demand for Targeted Advertising

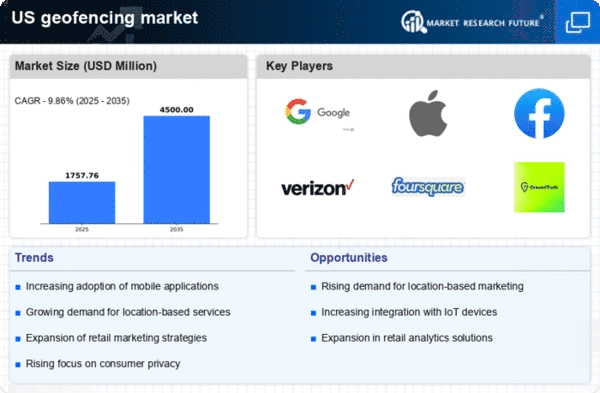

The geofencing market is experiencing a notable surge in demand for targeted advertising solutions. Businesses are increasingly recognizing the value of location-based marketing strategies to enhance customer engagement. In 2025, it is estimated that the market for targeted advertising will reach approximately $5 billion in the US alone. This growth is driven by the need for personalized marketing campaigns that resonate with consumers in real-time. As companies leverage geofencing technology to deliver tailored promotions and advertisements, the effectiveness of their marketing efforts is likely to improve significantly. This trend indicates a shift towards more data-driven decision-making in the geofencing market, as businesses seek to optimize their advertising spend and maximize return on investment.

Regulatory Developments in Location Data Usage

The geofencing market is also being shaped by regulatory developments concerning the usage of location data. As privacy concerns continue to rise, businesses must navigate a complex landscape of regulations aimed at protecting consumer data. In 2025, it is expected that stricter regulations will be implemented, requiring companies to adopt transparent practices regarding data collection and usage. This shift may compel businesses to invest in more robust compliance measures and technologies to ensure adherence to legal standards. Consequently, the geofencing market may experience a transformation as organizations seek to balance effective marketing strategies with the need for ethical data practices.