Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and funding for neurological disorders are playing a pivotal role in the freeze of-gait market. Various federal and state programs are being implemented to support research and development in this area, which may lead to breakthroughs in treatment options. For instance, the National Institutes of Health (NIH) has allocated substantial funding for studies focused on gait disturbances associated with neurological conditions. Such initiatives not only foster innovation but also encourage collaboration between academic institutions and industry players. The freeze of-gait market is likely to experience growth as a result of these supportive policies, which aim to enhance patient outcomes and drive advancements in therapeutic solutions.

Advancements in Assistive Technologies

Technological advancements in assistive devices are transforming the freeze of-gait market. Innovations such as wearable sensors, smart walking aids, and robotic exoskeletons are being developed to help individuals manage their gait disturbances. These devices not only enhance mobility but also provide real-time feedback to users, which can improve their overall quality of life. The market for assistive technologies is projected to grow at a CAGR of around 15% over the next five years, indicating a robust demand for solutions that address freeze of gait. As these technologies become more accessible and affordable, the freeze of-gait market is likely to witness a surge in adoption, further driving market growth.

Rising Incidence of Parkinson's Disease

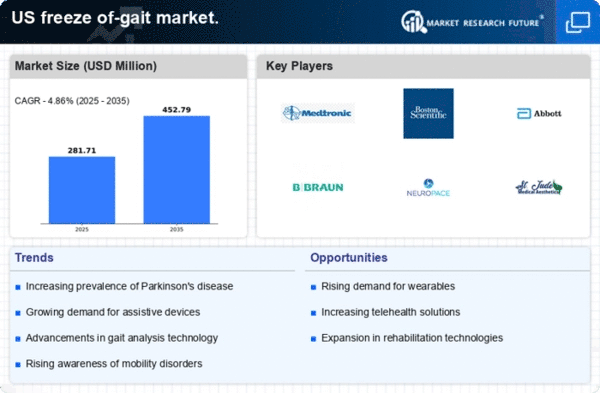

The increasing prevalence of Parkinson's disease in the US is a critical driver for the freeze of-gait market. As the population ages, the number of individuals diagnosed with Parkinson's is projected to rise significantly. According to recent estimates, approximately 1 million people in the US are living with Parkinson's, and this number is expected to double by 2040. This growing patient population is likely to drive demand for effective treatments and interventions aimed at managing symptoms, including freeze of gait. The freeze of-gait market is thus positioned to expand as healthcare providers seek innovative solutions to address the challenges faced by these patients, potentially leading to increased investments in research and development of new therapies.

Increased Focus on Rehabilitation Programs

There is a growing emphasis on rehabilitation programs tailored for individuals experiencing freeze of gait. Healthcare providers are increasingly recognizing the importance of multidisciplinary approaches that combine physical therapy, occupational therapy, and psychological support. This trend is reflected in the expansion of specialized rehabilitation centers across the US, which are designed to cater to the unique needs of patients with gait disorders. The freeze of-gait market stands to benefit from this shift, as more patients seek comprehensive treatment plans that address both physical and emotional aspects of their condition. As a result, investment in rehabilitation services is expected to rise, potentially enhancing the overall market landscape.

Growing Demand for Home Healthcare Solutions

The demand for home healthcare solutions is on the rise, particularly among elderly patients experiencing freeze of gait. As more individuals prefer to receive care in the comfort of their homes, there is an increasing need for products and services that facilitate independent living. This trend is reflected in the growing market for home-based therapies and assistive devices designed specifically for gait management. The freeze of-gait market is expected to capitalize on this shift, as companies develop innovative solutions that cater to the needs of home healthcare. With the potential for cost savings and improved patient satisfaction, the market is likely to see a surge in investment and product development aimed at enhancing home care for individuals with gait disturbances.