The Flight Management Systems Market is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for automation in aviation. Key players such as Honeywell International Inc (US), Rockwell Collins Inc (US), and Garmin Ltd (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Honeywell International Inc (US) focuses on innovation, particularly in integrating artificial intelligence (AI) into their systems, which appears to enhance operational efficiency and safety. Meanwhile, Rockwell Collins Inc (US) emphasizes strategic partnerships, collaborating with airlines to tailor solutions that meet specific operational needs, thereby strengthening customer loyalty. Garmin Ltd (US) is leveraging its expertise in consumer electronics to introduce user-friendly interfaces in its flight management systems, appealing to a broader range of customers, including smaller operators.

The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing. The market structure is moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive environment fosters innovation, as companies strive to differentiate their offerings through advanced technology and customer-centric solutions.

In November 2025, Honeywell International Inc (US) announced the launch of its latest flight management system, which incorporates AI-driven predictive analytics. This strategic move is significant as it positions Honeywell to lead in the automation trend, potentially reducing pilot workload and enhancing flight safety. The integration of AI is likely to attract airlines looking to modernize their fleets and improve operational efficiency.

In December 2025, Rockwell Collins Inc (US) entered into a partnership with a major airline to develop customized flight management solutions tailored to the airline's specific operational challenges. This collaboration underscores Rockwell Collins' commitment to understanding customer needs and adapting its offerings accordingly. Such partnerships may enhance customer retention and create a competitive edge in a market where personalized service is increasingly valued.

In October 2025, Garmin Ltd (US) unveiled a new line of flight management systems designed specifically for small to mid-sized aircraft. This strategic introduction is noteworthy as it expands Garmin's market reach, catering to a segment that has been historically underserved. By focusing on user-friendly technology, Garmin is likely to capture a growing customer base that prioritizes ease of use and affordability.

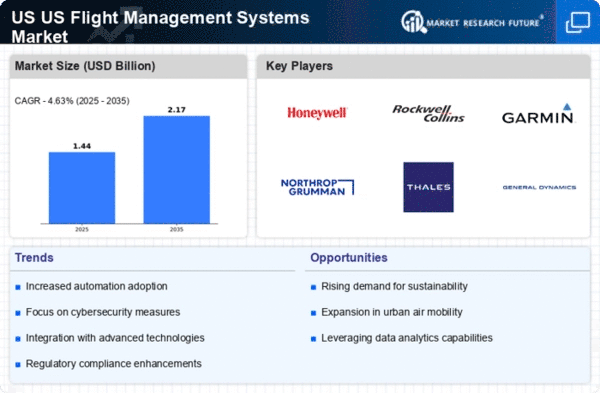

As of January 2026, the Flight Management Systems Market is witnessing trends such as digitalization, sustainability, and AI integration, which are reshaping competitive dynamics. Strategic alliances are becoming increasingly prevalent, as companies recognize the value of collaboration in driving innovation. The competitive landscape is shifting from price-based competition to a focus on technological advancement and supply chain reliability. This evolution suggests that future differentiation will hinge on the ability to innovate and adapt to emerging trends, positioning companies to thrive in an ever-evolving market.