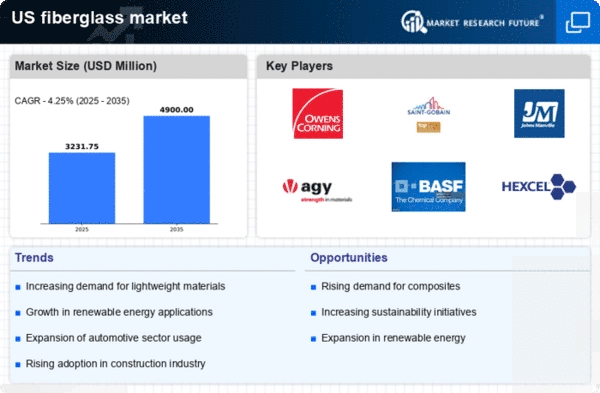

The fiberglass market in the United States is currently experiencing a notable transformation, driven by advancements in technology and increasing demand across various sectors. The construction industry, in particular, is witnessing a surge in the utilization of fiberglass materials due to their lightweight nature and superior strength. This shift is further supported by a growing emphasis on sustainability, as fiberglass products often contribute to energy efficiency and reduced environmental impact. Additionally, the automotive sector is increasingly adopting fiberglass components, which are favored for their durability and resistance to corrosion. As a result, manufacturers are investing in innovative production techniques to enhance the performance and application of fiberglass materials.

Moreover, the fiberglass market is likely to benefit from ongoing research and development efforts aimed at improving material properties and expanding applications. The aerospace and marine industries are also exploring the potential of fiberglass for various components, indicating a diversification of its usage. While challenges such as competition from alternative materials exist, the overall outlook for the fiberglass market appears positive. Stakeholders are encouraged to monitor trends closely, as shifts in consumer preferences and regulatory changes may influence market dynamics in the near future.

Sustainability Initiatives

The fiberglass market is increasingly aligning with sustainability initiatives, as manufacturers focus on producing eco-friendly materials. This trend is driven by regulatory pressures and consumer demand for greener products. Companies are exploring the use of recycled materials and developing processes that minimize waste, thereby enhancing their environmental credentials.

Technological Advancements

Technological advancements are playing a crucial role in the fiberglass market, with innovations in production techniques leading to improved material performance. Enhanced manufacturing processes are enabling the creation of lighter, stronger, and more versatile fiberglass products, which are appealing to various industries, including construction and automotive.

Diverse Applications

The fiberglass market is witnessing a diversification of applications, as industries such as aerospace, marine, and energy increasingly adopt fiberglass materials. This trend reflects a growing recognition of the benefits of fiberglass, including its strength-to-weight ratio and resistance to environmental factors, making it suitable for a wide range of uses.