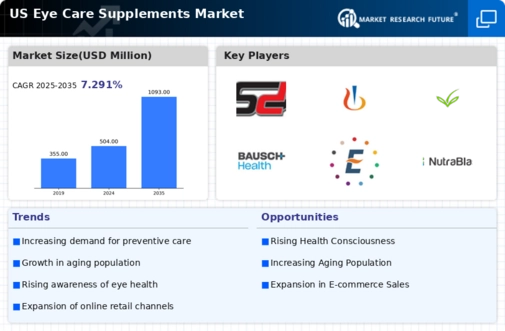

Aging Population

The aging population in the United States is a primary driver of the US eye care supplements market. As individuals age, they become more susceptible to various eye conditions, such as macular degeneration and cataracts. According to the U.S. Census Bureau, the number of Americans aged 65 and older is projected to reach 95 million by 2060. This demographic shift is likely to increase the demand for eye care supplements, as older adults seek preventive measures to maintain their vision health. Furthermore, the growing awareness of the importance of eye health among this age group may lead to higher consumption of supplements specifically formulated to support eye function. Consequently, the US eye care supplements market is expected to expand significantly in response to the needs of this aging population.

Rising Incidence of Eye Disorders

The rising incidence of eye disorders in the United States serves as a crucial driver for the US eye care supplements market. Conditions such as dry eye syndrome, diabetic retinopathy, and glaucoma are becoming increasingly prevalent, affecting millions of Americans. The American Academy of Ophthalmology reports that the number of people with age-related macular degeneration is expected to double by 2050. This alarming trend is likely to propel the demand for eye care supplements, as consumers seek effective solutions to mitigate the risks associated with these disorders. Additionally, the growing emphasis on preventive healthcare may encourage individuals to invest in eye care supplements as a proactive measure. As a result, the US eye care supplements market is poised for growth, driven by the urgent need to address the rising burden of eye disorders.

Growing E-commerce and Online Retail

The growing e-commerce and online retail landscape is reshaping the US eye care supplements market. With the rise of digital shopping platforms, consumers now have easier access to a wide range of eye care supplements. This shift in purchasing behavior is particularly pronounced among younger demographics, who prefer the convenience of online shopping. According to a report by the U.S. Department of Commerce, e-commerce sales in the health and personal care sector have seen substantial growth in recent years. This trend is likely to continue, as consumers increasingly turn to online retailers for their eye care supplement needs. As a result, the US eye care supplements market is expected to expand, driven by the accessibility and convenience offered by e-commerce platforms.

Increased Focus on Preventive Health

The increased focus on preventive health is significantly influencing the US eye care supplements market. Consumers are becoming more proactive about their health, seeking ways to prevent potential health issues before they arise. This trend is particularly evident in the eye care sector, where individuals are increasingly turning to supplements that claim to support eye health and prevent vision loss. The National Eye Institute emphasizes the importance of nutrition in maintaining eye health, which has led to a surge in the popularity of eye care supplements containing vitamins and antioxidants. As a result, the US eye care supplements market is likely to experience robust growth, as consumers prioritize preventive measures and invest in products that promote long-term eye health.

Technological Advancements in Supplement Formulation

Technological advancements in supplement formulation are driving innovation within the US eye care supplements market. The development of new delivery systems, such as soft gels and gummies, has made eye care supplements more appealing to consumers. Additionally, advancements in ingredient sourcing and formulation techniques have led to the creation of more effective products that cater to specific eye health needs. For instance, the incorporation of novel ingredients like lutein and zeaxanthin, which are known for their protective effects on the retina, is becoming increasingly common. These innovations not only enhance the efficacy of eye care supplements but also attract a broader consumer base. Consequently, the US eye care supplements market is likely to benefit from these technological advancements, as they contribute to the overall growth and diversification of product offerings.