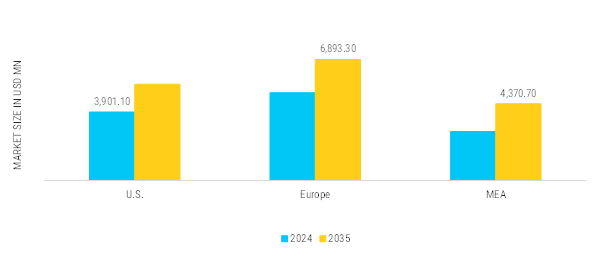

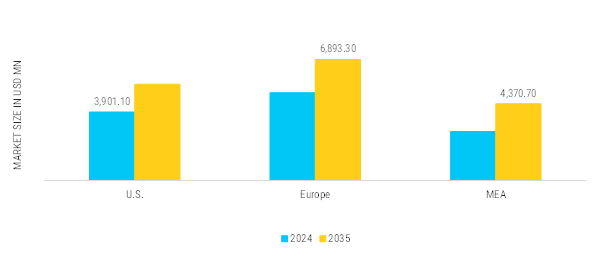

US.: Innovation Driving Advanced Rubber Demand

The US. rubber products market is driven by strong demand from the automotive, aerospace, healthcare, and construction industries. Automotive applications such as hoses, seals, gaskets, and vibration dampers form a major share, supported by a mature vehicle manufacturing ecosystem and rising adoption of electric vehicles. Additionally, the U.S. oil & gas and chemicals sectors require high-performance rubber products that withstand extreme temperatures and corrosive environments. Advanced materials like fluoro-rubber, silicone, and EPDM are gaining traction due to strict environmental and safety regulations. The U.S. market also benefits from robust R&D investments, well-established distribution networks, and the presence of global rubber manufacturers. For instance, in May 2023, University of Arizona researchers announced their partnership with Bridgestone Americas Inc. to advance a new variety of natural rubber from a source that is more sustainable and can be grown in the forbidding environments of the arid Southwest. Moreover, sustainability initiatives and the shift toward eco-friendly and recycled rubber products are influencing purchasing decisions. Labor costs and raw material price fluctuations remain challenges, but the country continues to dominate in innovation and specialty rubber product demand, making it one of the leading countries in the market.

Europe: Sustainability Accelerating Advanced Rubber Innovation

Europe’s rubber products market is shaped by stringent regulatory frameworks, technological advancements, and sustainability commitments. The region’s automotive sector, led by Germany, France, Italy, and others, is a primary consumer of rubber products such as hoses, seals, and CV joint boots. Construction, mining, and energy industries also provide consistent demand, especially for high-durability rubber hoses and sealing solutions. European Union regulations focusing on eco-friendly materials and recycling have accelerated the adoption of green rubber technologies, such as bio-based and reclaimed rubber. Furthermore, the chemical and petrochemical industries in regions such as Benelux and Eastern Europe drive the need for specialized, high-performance rubber products resistant to extreme operating conditions. The region also emphasizes innovation in lightweight and high-efficiency rubber materials to support electric vehicles and renewable energy projects. While raw material cost volatility and competitive imports pose challenges, Europe remains a hub for premium, technologically advanced rubber products tailored for sustainability.

MEA: Infrastructure Growth Fueling Rubber Demand

Middle East and Africa’s rubber products market is expanding due to infrastructure development, mining activities, and agricultural growth. Africa is rapidly emerging as a critical player in the global natural rubber supply chain, particularly in meeting the growing demand from the European Union (EU). In addition, countries such as South Africa, Nigeria, Kenya, and others are witnessing increased demand for rubber hoses, mats, sealing solutions, and industrial components in construction and mining operations. The continent’s vast oil & gas reserves, particularly in Nigeria and Angola, also drive consumption of rubber sealing solutions and high-pressure hoses. Furthermore, agriculture heavily relies on rubber hoses, belts, and mats for irrigation, equipment, and livestock applications. Automotive demand is largely aftermarket-driven, supported by rising vehicle ownership and maintenance needs. The region, however, faces challenges such as limited local manufacturing capacity, dependency on imports, and fluctuating raw material costs. Nonetheless, Africa has potential growth opportunities as governments push for industrialization and infrastructure expansion. With foreign investments and regional free trade agreements boosting industrial activities, demand for durable, cost-effective rubber products is expected to increase steadily.