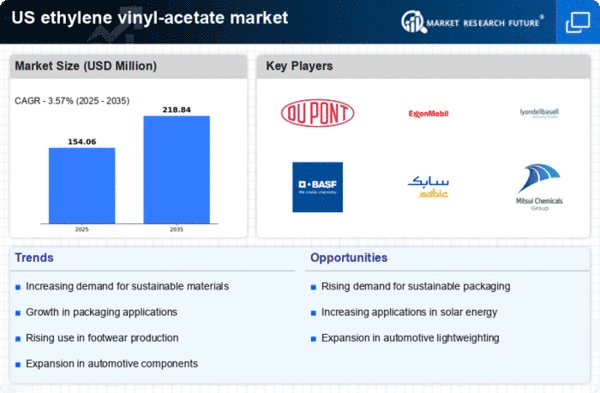

The ethylene vinyl-acetate market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as DuPont (US), ExxonMobil (US), and LyondellBasell (US) are actively pursuing strategies that emphasize technological advancements and market expansion. DuPont (US), for instance, has been focusing on enhancing its product portfolio through sustainable practices, which aligns with the growing demand for eco-friendly materials. Meanwhile, ExxonMobil (US) appears to be leveraging its extensive supply chain capabilities to optimize production efficiency, thereby maintaining a competitive edge in pricing and availability. LyondellBasell (US) is also notable for its commitment to digital transformation, which is likely to enhance operational efficiencies and customer engagement.The business tactics employed by these companies reflect a moderately fragmented market structure, where localized manufacturing and supply chain optimization are pivotal. The collective influence of these key players suggests a dynamic interplay of competition, where innovation and operational excellence are paramount. As companies strive to differentiate themselves, the focus on sustainability and technological integration is becoming increasingly pronounced.

In September DuPont (US) announced a significant investment in a new production facility aimed at increasing its capacity for sustainable ethylene vinyl-acetate products. This strategic move is expected to bolster its market position by catering to the rising demand for environmentally friendly materials, thereby aligning with global sustainability goals. The establishment of this facility not only enhances production capabilities but also reinforces DuPont's commitment to innovation in the sector.

In August ExxonMobil (US) unveiled a new initiative to enhance its supply chain resilience through advanced digital technologies. This initiative is likely to streamline operations and reduce costs, positioning ExxonMobil favorably against competitors. By integrating AI and data analytics into its supply chain processes, the company aims to improve forecasting accuracy and operational agility, which could be crucial in responding to market fluctuations.

In October LyondellBasell (US) entered into a strategic partnership with a leading technology firm to develop next-generation ethylene vinyl-acetate products. This collaboration is indicative of a broader trend towards innovation-driven partnerships, which may enhance product offerings and accelerate time-to-market. By leveraging external expertise, LyondellBasell is likely to strengthen its competitive position and respond more effectively to evolving customer needs.

As of November the competitive trends in the ethylene vinyl-acetate market are increasingly defined by digitalization, sustainability, and strategic alliances. Companies are shifting from traditional price-based competition to a focus on innovation and technology integration. The formation of strategic partnerships is shaping the landscape, enabling firms to pool resources and expertise. Looking ahead, competitive differentiation is expected to evolve, with an emphasis on supply chain reliability and sustainable practices becoming central to market success.