Regulatory Support and Frameworks

Regulatory support plays a pivotal role in shaping the US Drone Inspection Monitoring Market. The Federal Aviation Administration (FAA) has established guidelines that facilitate the safe integration of drones into national airspace. These regulations not only ensure safety but also promote innovation within the industry. As regulations become more favorable, businesses are more inclined to invest in drone technology for inspections. Additionally, state and local governments are increasingly recognizing the benefits of drone inspections for public infrastructure projects, leading to supportive policies and funding initiatives. This regulatory landscape is expected to foster growth in the market, as companies seek to leverage drones for compliance and efficiency in their operations.

Enhanced Safety and Risk Mitigation

Safety concerns are paramount in the US Drone Inspection Monitoring Market, particularly in sectors such as construction and energy. Drones significantly reduce the risks associated with manual inspections, especially in hazardous environments. By utilizing drones, companies can conduct inspections from a safe distance, minimizing the potential for accidents and injuries. This shift towards safer inspection methods is supported by regulatory bodies that advocate for the adoption of technology that enhances worker safety. Furthermore, the ability of drones to capture high-resolution images and data allows for more accurate assessments, which can lead to timely interventions and risk mitigation. As safety regulations continue to evolve, the demand for drone inspections is expected to rise, further solidifying their role in the market.

Integration of Advanced Technologies

The integration of advanced technologies is transforming the US Drone Inspection Monitoring Market. Innovations such as artificial intelligence, machine learning, and data analytics are enhancing the capabilities of drone inspections. These technologies enable drones to not only capture images but also analyze data in real-time, providing actionable insights for decision-makers. For example, AI algorithms can identify anomalies in infrastructure that may require immediate attention, streamlining the inspection process. As these technologies continue to evolve, they are expected to drive further adoption of drone inspections across various sectors, including telecommunications and agriculture. The synergy between drones and advanced technologies is likely to create new opportunities and applications within the market.

Cost Efficiency and Operational Savings

Cost efficiency is a critical driver in the US Drone Inspection Monitoring Market. Traditional inspection methods often involve significant labor costs, equipment rentals, and extended downtime. In contrast, drone inspections can be conducted more quickly and with fewer resources, leading to substantial operational savings. For instance, companies have reported reductions in inspection costs by up to 30% when utilizing drone technology. This financial incentive is particularly appealing to industries such as oil and gas, where regular inspections are necessary to maintain compliance and operational integrity. As organizations seek to optimize their budgets and improve their bottom lines, the adoption of drone technology for inspections is likely to accelerate, reinforcing its position in the market.

Growing Demand for Infrastructure Inspections

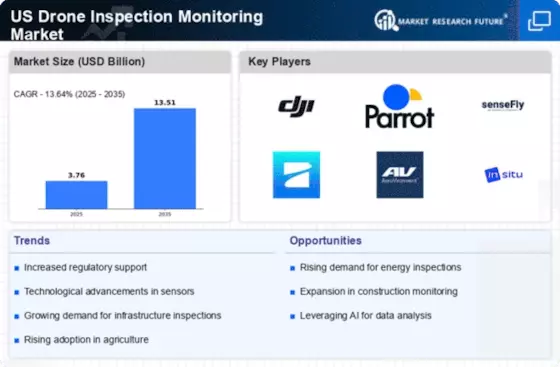

The US Drone Inspection Monitoring Market is experiencing a notable increase in demand for infrastructure inspections. As aging infrastructure becomes a pressing concern, the need for efficient and cost-effective inspection methods has surged. Drones offer a unique solution, enabling rapid assessments of bridges, roads, and buildings without the need for extensive scaffolding or manual labor. According to recent data, the market for drone inspections in infrastructure is projected to grow at a compound annual growth rate of over 15% through 2026. This growth is driven by the need for regular maintenance and safety checks, which are essential for preventing catastrophic failures and ensuring public safety. Consequently, the integration of drone technology into infrastructure monitoring is likely to become a standard practice across various sectors.