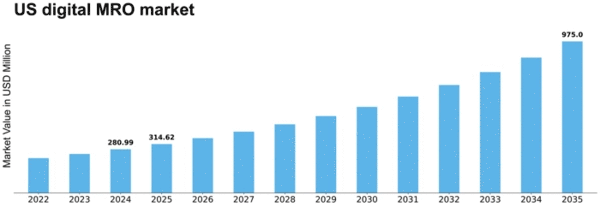

Us Digital Mro Size

US Digital MRO Market Growth Projections and Opportunities

The global digital Maintenance, Repair, and Operations (MRO) market are poised for substantial growth, primarily driven by increased investments in connected aircraft and the widespread adoption of cutting-edge technologies such as big data, the Internet of Things (IoT), blockchain, and Artificial Intelligence (AI) by MRO providers. This transformative shift within the aviation industry stems from the urgent need for enhanced operational efficiency, cost-effectiveness, and the integration of innovative solutions. Despite the promising outlook, challenges such as the absence of common data standards and the high costs associated with MRO software suites could potentially impede the market's growth. One of the primary catalysts propelling the digital MRO market forward is the escalating investments in connected aircraft. The aviation sector is increasingly recognizing the potential of connected systems in reducing operational costs, enhancing safety, and optimizing aircraft performance. This shift towards connectivity is a strategic response to the demands for real-time data, predictive maintenance, and improved decision-making capabilities in the aviation ecosystem. Moreover, the adoption of advanced technologies such as big data, IoT, blockchain, and AI by MRO providers plays a pivotal role in shaping the trajectory of the digital MRO market. These technologies empower MRO operations with data-driven insights, predictive analytics, and streamlined workflows, contributing to more efficient maintenance processes and reduced downtime. The convergence of these technologies marks a significant step toward a digital future for aircraft maintenance. Furthermore, the high costs associated with procuring new aircraft are steering airlines toward investments in digital MRO. Instead of solely focusing on new acquisitions, airlines increasingly recognize the economic advantages of optimizing the performance and longevity of their existing fleets through digital solutions. This strategic shift is not only cost-effective but also aligns with sustainability goals by maximizing the lifespan of aircraft. Despite the promising growth trajectory, the digital MRO market faces certain challenges. The absence of common data standards poses interoperability issues, hindering seamless collaboration among various stakeholders in the aviation ecosystem. Establishing standardized data protocols is crucial for the effective integration and utilization of digital MRO technologies. Another potential constraint is the high costs associated with MRO software suites. While the adoption of digital technologies promises long-term benefits, the initial investment required for implementing comprehensive MRO solutions can be a deterrent for some industry players. Striking a balance between short-term financial implications and the long-term advantages of digital MRO adoption remains a challenge.The global digital MRO market is anticipated to witness a Compound Annual Growth Rate (CAGR) of 12.04% during the forecast period from 2020 to 2027. In 2019, North America dominated the market with a substantial share of 34.32%, reflecting the region's proactive approach toward technological innovation in the aviation sector. Asia-Pacific and Europe followed closely, contributing shares of 27.07% and 25.23%, respectively. The distributed market share indicates global recognition of the transformative potential of digital MRO across diverse regions.In conclusion, the global digital MRO market stands at the cusp of significant growth, driven by the convergence of connected aircraft, advanced technologies, and the imperative to optimize existing fleets. While challenges like the absence of common data standards and upfront investment costs pose considerations, the overall trajectory is one of innovation, efficiency, and sustained industry evolution. North America's dominance underscores the region's leadership in embracing digital solutions, yet the global distribution of shares signals a widespread acknowledgment of the transformative power of digital MRO across the aviation landscape. As the industry continues to navigate toward a digital future, the skies of growth for the digital MRO market appear promising and expansive.

Leave a Comment