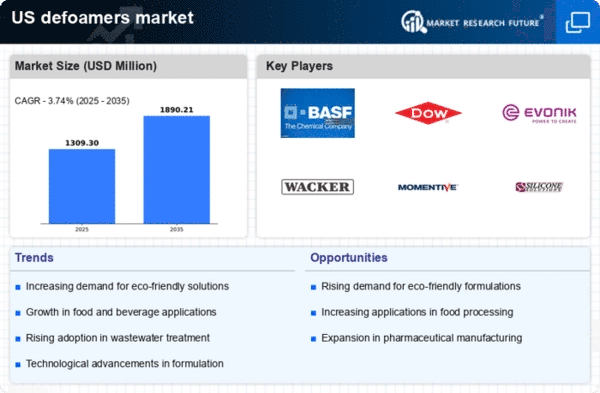

The defoamers market exhibits a competitive landscape characterized by a blend of innovation, strategic partnerships, and regional expansion. Key players such as BASF SE (Germany), Dow Inc. (US), and Evonik Industries AG (Germany) are actively shaping the market dynamics. BASF SE (Germany) focuses on sustainability and product innovation, aiming to enhance its portfolio with eco-friendly solutions. Dow Inc. (US) emphasizes digital transformation and supply chain optimization, which positions it favorably in a market increasingly driven by efficiency and responsiveness. Evonik Industries AG (Germany) leverages its strong R&D capabilities to develop specialized defoamers tailored for various applications, thereby enhancing its competitive edge. Collectively, these strategies foster a competitive environment that prioritizes innovation and sustainability, reflecting broader industry trends.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and enhance supply chain resilience. This approach is particularly relevant in a moderately fragmented market where agility can provide a competitive advantage. The collective influence of key players, including Momentive Performance Materials Inc. (US) and Wacker Chemie AG (Germany), further shapes the market structure, as they engage in strategic collaborations and optimize their operational frameworks to meet evolving customer demands.

In October Momentive Performance Materials Inc. (US) announced a strategic partnership with a leading agricultural firm to develop defoamers specifically designed for agrochemical applications. This collaboration is significant as it not only diversifies Momentive's product offerings but also aligns with the growing demand for specialized solutions in the agricultural sector, potentially enhancing its market share.

In September Wacker Chemie AG (Germany) launched a new line of silicone-based defoamers aimed at the construction industry. This product introduction is noteworthy as it reflects Wacker's commitment to innovation and its strategic focus on high-growth sectors. By catering to the construction industry's unique needs, Wacker positions itself to capture a larger segment of this market, which is expected to expand in the coming years.

In August Dow Inc. (US) expanded its manufacturing capabilities in the Midwest, investing approximately $50 million in a new facility dedicated to producing defoamers. This investment underscores Dow's strategy to enhance its production efficiency and meet the increasing demand for defoamers across various industries. The facility is expected to significantly reduce lead times and improve supply chain reliability, which are critical factors in maintaining competitive advantage.

As of November the defoamers market is witnessing trends that emphasize digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming increasingly pivotal, as companies seek to leverage complementary strengths to enhance their market positions. The competitive landscape is likely to evolve from traditional price-based competition towards a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize these aspects will be better positioned to differentiate themselves and capture market share in the future.