Increased Focus on Data Security

With the rise in cyber threats, data security has become a critical concern for organizations, thereby impacting the data center-structured-cabling market. Companies are investing heavily in secure data transmission methods to protect sensitive information. This focus on security is leading to the adoption of advanced cabling solutions that offer enhanced shielding and protection against unauthorized access. The data center-structured-cabling market is responding to this trend by developing products that not only meet performance standards but also comply with stringent security regulations. As a result, the market is likely to see a shift towards more secure cabling options that can withstand potential vulnerabilities.

Regulatory Compliance and Standards

The evolving landscape of regulatory compliance is a significant driver for the data center-structured-cabling market. Organizations are increasingly required to adhere to various standards and regulations concerning data handling and transmission. Compliance with these regulations often necessitates the upgrade of existing cabling systems to meet new performance and safety standards. The data center-structured-cabling market is thus witnessing a demand for products that not only fulfill regulatory requirements but also enhance operational efficiency. This trend is likely to continue as regulations become more stringent, pushing companies to invest in compliant cabling solutions.

Expansion of Cloud Computing Services

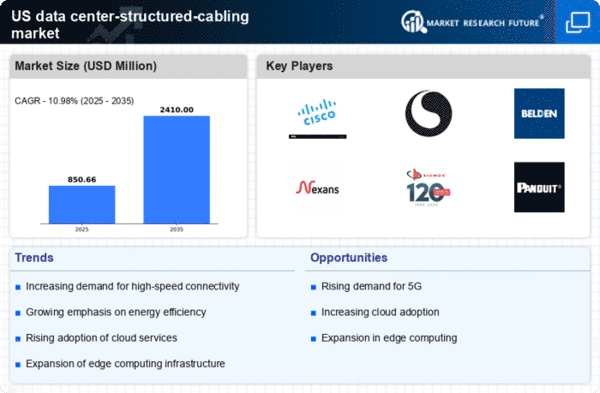

The rapid expansion of cloud computing services is significantly influencing the data center-structured-cabling market. As organizations increasingly migrate to cloud-based solutions, the need for robust and efficient cabling systems becomes paramount. The cloud services market is anticipated to grow at a CAGR of around 22% through 2025, necessitating the enhancement of data center infrastructures. This growth drives demand for advanced cabling solutions that can support high data loads and ensure reliable connectivity. Consequently, the data center-structured-cabling market is adapting to these changes by offering innovative cabling technologies that facilitate seamless cloud integration and scalability.

Rising Demand for High-Speed Connectivity

The increasing reliance on high-speed internet and data transfer capabilities is a primary driver for the data center-structured-cabling market. As businesses and consumers demand faster connectivity, data centers are compelled to upgrade their cabling infrastructure. This trend is evidenced by the projected growth of the data center market, which is expected to reach approximately $200 billion by 2026. Enhanced cabling solutions, particularly those utilizing fiber optics, are essential to meet these demands. The data center-structured-cabling market is thus experiencing a surge in investments aimed at improving bandwidth and reducing latency, which are critical for supporting cloud computing and big data applications.

Technological Advancements in Cabling Solutions

Technological advancements are reshaping the data center-structured-cabling market, driving innovation and efficiency. The introduction of new materials and designs, such as high-density cabling and modular systems, is enabling data centers to optimize space and improve performance. These advancements are crucial as data centers strive to manage increasing data volumes and improve energy efficiency. The data center-structured-cabling market is likely to benefit from ongoing research and development efforts aimed at creating more efficient and sustainable cabling solutions. As technology continues to evolve, the market is expected to adapt, offering products that meet the changing needs of data centers.