Growing Demand for Real-Time Analytics

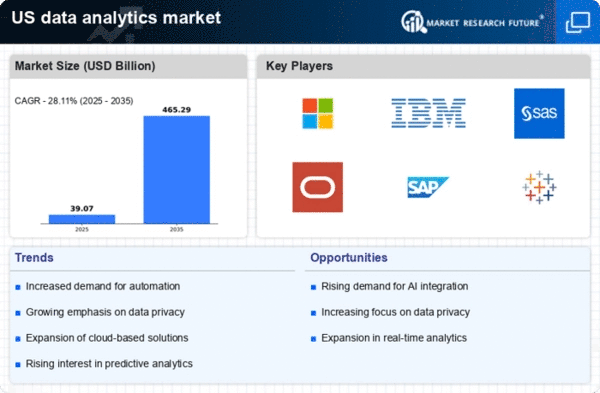

The data analytics market is experiencing a notable surge in demand for real-time analytics solutions. Organizations are increasingly recognizing the value of immediate insights derived from data, which can enhance decision-making processes. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 30% over the next five years. This growth is driven by the need for businesses to respond swiftly to market changes and customer preferences. As a result, companies are investing heavily in technologies that facilitate real-time data processing and analysis. The data analytics market is thus evolving to meet these demands, with a focus on integrating advanced technologies such as streaming analytics and in-memory computing to provide timely insights.

Expansion of Cloud-Based Analytics Solutions

The shift towards cloud computing is significantly impacting the data analytics market. Organizations are increasingly adopting cloud-based analytics solutions due to their scalability, flexibility, and cost-effectiveness. The cloud analytics market is expected to reach a valuation of over $100 billion by 2026, reflecting a robust growth trajectory. This transition allows businesses to leverage vast amounts of data without the need for extensive on-premises infrastructure. Furthermore, cloud-based solutions facilitate collaboration and accessibility, enabling teams to analyze data from anywhere. As a result, the data analytics market is witnessing a transformation, with cloud providers enhancing their offerings to include advanced analytics capabilities, thereby catering to the evolving needs of businesses.

Increased Focus on Data Security and Privacy

As data breaches and privacy concerns continue to rise, the data analytics market is witnessing an increased focus on data security and privacy measures. Organizations are compelled to implement robust security protocols to protect sensitive information while complying with regulations such as GDPR and CCPA. This heightened awareness is driving investments in security solutions that integrate seamlessly with analytics platforms. The market for data security solutions is expected to grow significantly, with estimates suggesting a CAGR of around 20% over the next few years. Consequently, the data analytics market is evolving to prioritize security features, ensuring that organizations can analyze data without compromising on privacy and compliance.

Integration of Advanced Analytics Techniques

The integration of advanced analytics techniques, such as predictive and prescriptive analytics, is reshaping the data analytics market. Organizations are increasingly seeking to go beyond descriptive analytics to gain deeper insights into future trends and behaviors. This shift is evidenced by a projected growth rate of 25% for predictive analytics solutions over the next few years. By employing these advanced techniques, businesses can optimize their operations and enhance customer experiences. The data analytics market is responding by developing sophisticated tools that incorporate machine learning algorithms and statistical modeling, enabling organizations to make more informed decisions based on predictive insights. This trend is likely to drive further innovation in the analytics space.

Rising Importance of Data-Driven Decision Making

In the current business landscape, the emphasis on data-driven decision making is becoming increasingly pronounced. Organizations are recognizing that leveraging data analytics can lead to improved operational efficiency and competitive advantage. A recent survey indicates that approximately 70% of companies are prioritizing data analytics initiatives to inform their strategic decisions. This trend is fostering a culture of analytics within organizations, where data is viewed as a critical asset. Consequently, the data analytics market is adapting to support this shift, with a growing focus on providing tools and platforms that empower users to derive actionable insights from data. This cultural shift is likely to continue driving investment in analytics technologies.