Growing Awareness of Knee Health

There is a growing awareness of knee health and injury prevention among the US population, which is positively impacting the Cruciate Ligament Diagnosis and Treatment market. Educational campaigns and community programs aimed at promoting knee health are becoming more prevalent, leading to increased public knowledge about ACL injuries and their consequences. This heightened awareness encourages individuals to seek timely medical attention for knee injuries, thereby driving demand for diagnostic services and treatment options. As more people recognize the importance of early intervention, the industry is likely to benefit from an influx of patients seeking care for cruciate ligament injuries.

Rising Incidence of Sports Injuries

The US Cruciate Ligament Diagnosis and Treatment market is experiencing growth due to the increasing incidence of sports-related injuries, particularly among athletes and active individuals. According to the American Academy of Orthopaedic Surgeons, approximately 200,000 anterior cruciate ligament (ACL) injuries occur annually in the United States. This trend is likely to continue as more people engage in high-impact sports, leading to a greater demand for effective diagnosis and treatment options. The rise in sports participation, especially among youth and recreational athletes, suggests that the market for cruciate ligament treatments will expand, necessitating advancements in diagnostic technologies and surgical techniques to address these injuries.

Advancements in Diagnostic Technologies

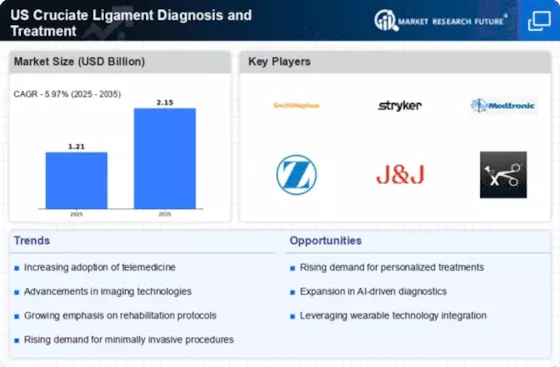

Innovations in diagnostic technologies are significantly influencing the US Cruciate Ligament Diagnosis and Treatment market. The introduction of advanced imaging techniques, such as MRI and 3D ultrasound, has improved the accuracy of ACL injury diagnoses. These technologies allow for better visualization of ligament damage, which is crucial for determining appropriate treatment plans. As healthcare providers increasingly adopt these advanced diagnostic tools, the market is likely to see enhanced patient outcomes and reduced recovery times. Furthermore, the integration of artificial intelligence in imaging analysis may further streamline the diagnostic process, making it more efficient and reliable.

Increased Investment in Sports Medicine

The US Cruciate Ligament Diagnosis and Treatment market is benefiting from increased investment in sports medicine. As professional and amateur sports organizations recognize the importance of athlete health and performance, funding for research and development in injury prevention and treatment is on the rise. This investment is leading to the development of new surgical techniques, rehabilitation protocols, and diagnostic tools specifically designed for cruciate ligament injuries. Additionally, partnerships between sports organizations and medical institutions are fostering innovation in treatment options, which may enhance the overall quality of care provided to athletes and active individuals.

Regulatory Support for Innovative Treatments

Regulatory support for innovative treatments is playing a crucial role in shaping the US Cruciate Ligament Diagnosis and Treatment market. The Food and Drug Administration (FDA) has been actively approving new medical devices and therapies aimed at improving the diagnosis and treatment of ACL injuries. This regulatory environment encourages the development of cutting-edge technologies, such as biologic treatments and minimally invasive surgical techniques. As these innovations gain approval and enter the market, they are likely to enhance patient outcomes and expand treatment options for individuals suffering from cruciate ligament injuries, thereby driving industry growth.