Regulatory Support for Innovation

The US corneal surgery devices market is bolstered by a favorable regulatory environment that encourages innovation and the introduction of new technologies. The Food and Drug Administration (FDA) has streamlined the approval process for novel surgical devices, allowing for quicker access to cutting-edge solutions. This regulatory support is crucial for manufacturers aiming to bring innovative products to market, as it fosters a competitive landscape that drives advancements in surgical techniques. Recent statistics indicate that the number of FDA-approved corneal surgery devices has increased by 20% in the last two years, reflecting the agency's commitment to enhancing patient care. As regulatory frameworks continue to evolve, the US corneal surgery devices market is poised for sustained growth and innovation.

Increased Patient Awareness and Demand

In recent years, there has been a notable increase in patient awareness regarding eye health and the availability of corneal surgery options. The US corneal surgery devices market benefits from this heightened awareness, as more individuals are seeking corrective procedures for vision impairments. Educational campaigns and the proliferation of information through digital platforms have empowered patients to make informed decisions about their eye care. This trend is reflected in the rising number of consultations and surgeries, with a reported increase of 15% in elective corneal procedures over the past year. As patients become more proactive about their eye health, the demand for advanced surgical devices is expected to grow, further propelling the US corneal surgery devices market.

Technological Advancements in Surgical Devices

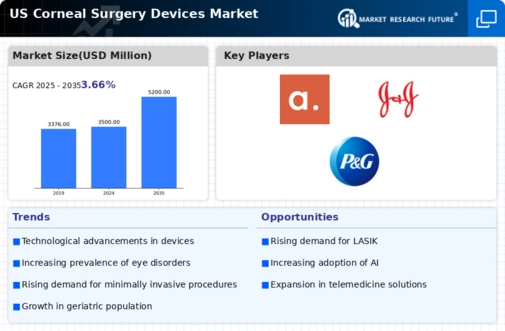

The US corneal surgery devices market is experiencing a surge in technological advancements that enhance surgical precision and patient outcomes. Innovations such as femtosecond lasers and advanced imaging systems are revolutionizing corneal procedures, allowing for minimally invasive techniques. According to recent data, the adoption of these technologies has led to a significant increase in the number of procedures performed annually, with estimates suggesting a growth rate of approximately 8% over the next five years. These advancements not only improve the efficacy of surgeries but also reduce recovery times, thereby attracting more patients to seek surgical interventions. As technology continues to evolve, the US corneal surgery devices market is likely to witness further enhancements that could redefine standard practices.

Aging Population and Rising Incidence of Eye Disorders

The demographic shift towards an aging population in the United States is a significant driver for the US corneal surgery devices market. As individuals age, the prevalence of eye disorders such as cataracts and keratoconus increases, necessitating surgical interventions. Current projections suggest that by 2030, nearly 20% of the US population will be over the age of 65, leading to a corresponding rise in demand for corneal surgeries. This trend is further supported by data indicating that the incidence of corneal diseases has risen by approximately 10% in the last decade. Consequently, the US corneal surgery devices market is likely to expand as healthcare providers seek to address the growing needs of this demographic.

Integration of Telemedicine in Preoperative Assessments

The integration of telemedicine into preoperative assessments is emerging as a transformative factor in the US corneal surgery devices market. This approach allows for remote consultations, enabling patients to receive expert evaluations without the need for in-person visits. The convenience and accessibility of telemedicine have led to an increase in patient engagement and satisfaction, which is crucial for surgical success. Recent surveys indicate that approximately 30% of patients prefer telehealth options for initial consultations, reflecting a shift in patient behavior. As telemedicine continues to gain traction, the US corneal surgery devices market is likely to benefit from increased patient throughput and improved access to surgical care.