Supportive Regulatory Environment

The regulatory landscape in the United States is becoming increasingly supportive of the US corneal cross linking devices market. The Food and Drug Administration (FDA) has streamlined the approval process for new corneal cross linking devices, facilitating quicker access to innovative treatments for patients. This regulatory support encourages manufacturers to invest in research and development, leading to the introduction of advanced devices that meet the evolving needs of healthcare providers and patients. Additionally, the establishment of clear guidelines for the use of corneal cross linking procedures has fostered confidence among practitioners, further driving the adoption of these devices. As a result, the US corneal cross linking devices market is likely to benefit from a favorable regulatory environment that promotes innovation and enhances patient care.

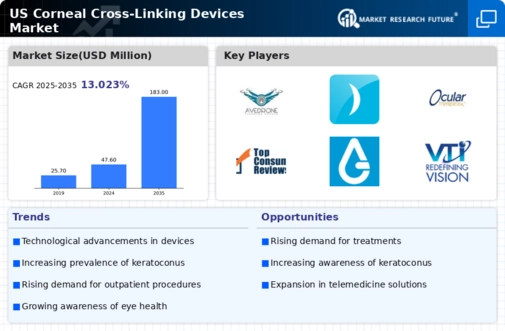

Increasing Prevalence of Keratoconus

The rising incidence of keratoconus in the United States is a primary driver for the US corneal cross linking devices market. Keratoconus, a progressive eye disease that leads to the thinning of the cornea, affects approximately 1 in 500 individuals in the US. As awareness of this condition grows, more patients seek treatment options, thereby increasing the demand for corneal cross linking procedures. The US corneal cross linking devices market is expected to expand as healthcare providers adopt these devices to offer effective solutions for keratoconus management. Furthermore, the increasing prevalence of myopia, which is often associated with keratoconus, may further contribute to the market's growth. This trend suggests a potential for sustained demand for innovative corneal cross linking technologies in the coming years.

Growing Awareness and Education Initiatives

Increasing awareness and education initiatives regarding corneal diseases and treatment options are driving the US corneal cross linking devices market. Healthcare organizations and advocacy groups are actively promoting information about keratoconus and the benefits of corneal cross linking. This heightened awareness is leading to more patients seeking consultations and treatment options. Educational campaigns aimed at both healthcare professionals and the general public are crucial in dispelling myths and providing accurate information about the effectiveness of corneal cross linking. As more individuals become informed about their options, the demand for corneal cross linking procedures is expected to rise, thereby positively impacting the US corneal cross linking devices market. This trend suggests a potential for sustained growth as awareness continues to expand.

Rising Demand for Vision Correction Procedures

The US corneal cross linking devices market is experiencing growth due to the increasing demand for vision correction procedures. Patients are increasingly seeking alternatives to traditional corrective methods, such as glasses and contact lenses. Corneal cross linking has emerged as a viable option for stabilizing the cornea and improving visual acuity. According to recent data, the number of corneal cross linking procedures performed in the US has seen a notable increase, indicating a shift in patient preferences towards more permanent solutions. This trend is likely to continue as advancements in technology enhance the effectiveness and safety of these procedures. As a result, the US corneal cross linking devices market is poised for expansion, driven by the growing patient base seeking innovative vision correction options.

Technological Innovations in Cross Linking Devices

Technological advancements in corneal cross linking devices are significantly influencing the US corneal cross linking devices market. Innovations such as the development of new riboflavin formulations and improved delivery systems have enhanced the efficacy and safety of cross linking procedures. These advancements not only improve patient outcomes but also increase the adoption of these devices among ophthalmologists. The introduction of devices that allow for faster treatment times and reduced discomfort is likely to attract more patients to seek corneal cross linking as a treatment option. As the market continues to evolve, the integration of cutting-edge technologies will play a crucial role in shaping the future of the US corneal cross linking devices market, potentially leading to increased market penetration and growth.