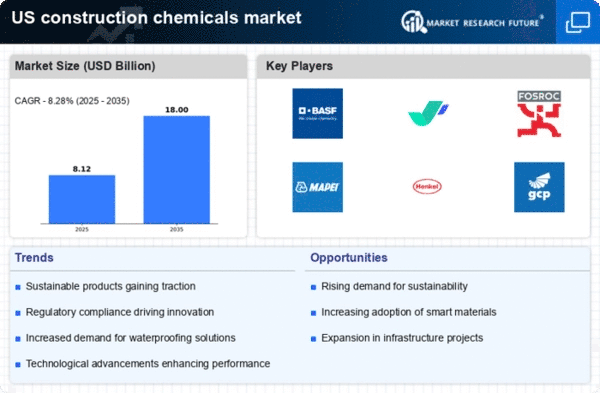

The construction chemicals market is currently characterized by a dynamic competitive landscape, driven by increasing demand for sustainable building materials and advanced construction technologies. Key players such as BASF (DE), Sika (CH), and GCP Applied Technologies (US) are strategically positioned to leverage innovation and regional expansion to enhance their market presence. BASF (DE) focuses on developing eco-friendly products, while Sika (CH) emphasizes digital transformation and smart construction solutions. GCP Applied Technologies (US) is enhancing its operational focus on specialty construction chemicals, which collectively shapes a competitive environment that is increasingly oriented towards sustainability and technological advancement.In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains, which is crucial in a moderately fragmented market. The competitive structure is influenced by the collective actions of these key players, who are increasingly collaborating with local suppliers and investing in regional production facilities to meet the growing demand for construction chemicals. This localized approach not only enhances supply chain efficiency but also allows for better responsiveness to market needs.

In October Sika (CH) announced a strategic partnership with a leading technology firm to develop AI-driven solutions for construction project management. This move is significant as it positions Sika at the forefront of digital innovation in the construction chemicals sector, potentially streamlining operations and improving project outcomes through enhanced data analytics and predictive modeling.

In September GCP Applied Technologies (US) launched a new line of sustainable concrete additives aimed at reducing carbon emissions during the construction process. This initiative reflects a growing trend towards sustainability, as GCP seeks to differentiate itself in a competitive market increasingly focused on environmental impact. The introduction of these products may enhance GCP's market share by appealing to environmentally conscious consumers and regulatory bodies.

In August BASF (DE) expanded its production capacity in North America by investing $50 million in a new facility dedicated to advanced construction chemicals. This expansion is indicative of BASF's commitment to meeting the rising demand for innovative construction solutions and reinforces its competitive position in the market. The increased capacity is expected to enhance supply chain reliability and responsiveness to customer needs.

As of November current competitive trends are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly important, as companies seek to combine resources and expertise to drive innovation. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on technological advancements, sustainability, and supply chain reliability, suggesting a transformative shift in how companies compete in the construction chemicals market.