Growing Demand for Automation

The US Collaborative Robots Market Industry is experiencing a notable surge in demand for automation across various sectors. Industries such as manufacturing, logistics, and healthcare are increasingly adopting collaborative robots to enhance productivity and efficiency. According to recent data, the market for collaborative robots in the US is projected to reach approximately USD 2 billion by 2026, driven by the need for streamlined operations and reduced labor costs. This growing demand is indicative of a broader trend towards automation, where businesses seek to remain competitive in a rapidly evolving landscape. Collaborative robots, with their ability to work alongside human operators, are particularly appealing as they can be easily integrated into existing workflows, thereby minimizing disruption while maximizing output.

Rising Focus on Workplace Safety

The US Collaborative Robots Market Industry is increasingly characterized by a heightened focus on workplace safety. Collaborative robots are designed to work alongside human operators, which inherently reduces the risk of accidents and injuries associated with traditional industrial robots. This emphasis on safety is particularly relevant in sectors such as manufacturing and warehousing, where the potential for workplace hazards is significant. Companies are recognizing that investing in collaborative robots not only enhances productivity but also contributes to a safer working environment. As safety regulations become more stringent, the demand for collaborative robots is likely to increase, with market analysts projecting a steady growth trajectory as organizations prioritize both efficiency and employee well-being.

Regulatory Support and Incentives

The US Collaborative Robots Market Industry benefits from a favorable regulatory environment that encourages the adoption of automation technologies. Government initiatives aimed at promoting advanced manufacturing and technological innovation are providing financial incentives for businesses to invest in collaborative robots. Programs designed to support small and medium enterprises (SMEs) in adopting automation solutions are particularly impactful, as they help reduce the financial burden associated with initial investments. Furthermore, regulatory frameworks that prioritize safety and compliance in the use of collaborative robots are fostering a more conducive environment for their deployment. This supportive landscape is likely to drive growth in the collaborative robots market, as companies are more inclined to embrace these technologies when backed by governmental support.

Technological Advancements in Robotics

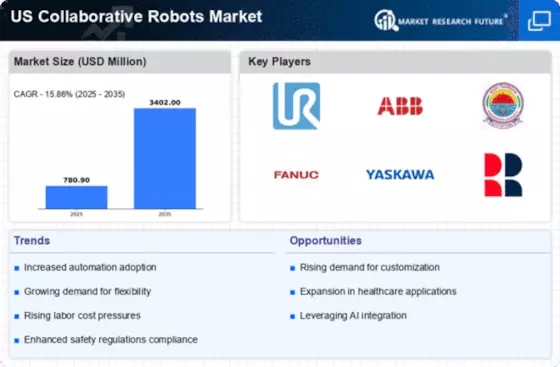

The US Collaborative Robots Market Industry is witnessing rapid technological advancements that are enhancing the capabilities and applications of collaborative robots. Innovations in artificial intelligence, machine learning, and sensor technologies are enabling robots to perform increasingly complex tasks with greater precision and reliability. These advancements are not only improving the functionality of collaborative robots but also expanding their applicability across diverse industries, including healthcare, automotive, and electronics. As companies seek to leverage these technological improvements, the market for collaborative robots is expected to expand significantly. Projections indicate that the US market could see a growth rate of over 25% annually, driven by the continuous evolution of robotics technology and its integration into various operational processes.

Labor Shortages and Workforce Challenges

The US Collaborative Robots Market Industry is significantly influenced by ongoing labor shortages and workforce challenges. Many sectors, particularly manufacturing and agriculture, are facing difficulties in finding skilled labor. This situation has prompted companies to explore alternative solutions, such as collaborative robots, which can alleviate the pressure of labor shortages. The integration of collaborative robots allows businesses to maintain production levels without the need for extensive human labor, thus addressing the immediate challenges posed by workforce constraints. As a result, the market for collaborative robots is expected to grow, with estimates suggesting a compound annual growth rate of around 30% over the next few years, reflecting the urgent need for innovative solutions in the face of labor market dynamics.