Emergence of Edge Computing

The emergence of edge computing is reshaping the cognitive services-platform market by enabling real-time data processing closer to the source. This shift allows organizations to leverage cognitive services in environments where low latency and high-speed processing are critical. Industries such as manufacturing and transportation are particularly benefiting from this trend, as edge computing facilitates immediate decision-making and enhances operational efficiency. The edge computing market is projected to grow significantly, with estimates suggesting a value of $43 billion by 2027. As businesses increasingly adopt edge solutions, the cognitive services-platform market is likely to evolve, integrating more edge capabilities to meet the demands of modern applications.

Rising Demand for Automation

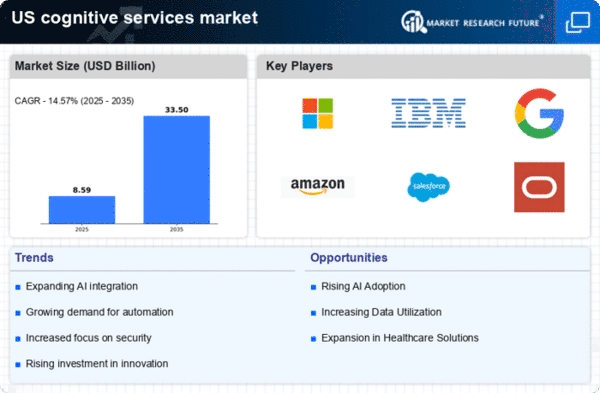

The cognitive services-platform market experiences a notable surge in demand for automation across various sectors. Organizations are increasingly seeking to enhance operational efficiency and reduce human error through automated processes. This trend is particularly evident in industries such as finance, healthcare, and retail, where cognitive services can streamline workflows and improve decision-making. According to recent estimates, the automation market is projected to reach $200 billion by 2025, indicating a robust growth trajectory. As businesses recognize the potential of cognitive services to facilitate automation, investments in these platforms are likely to increase, driving further innovation and adoption within the cognitive services-platform market.

Integration of Advanced Analytics

The integration of advanced analytics into cognitive services platforms is transforming the landscape of data-driven decision-making. Organizations are increasingly leveraging these platforms to extract actionable insights from vast amounts of data. The cognitive services-platform market is witnessing a shift towards solutions that incorporate machine learning and predictive analytics, enabling businesses to anticipate trends and make informed choices. In fact, the analytics market is expected to grow at a CAGR of 25% through 2025, underscoring the importance of data analytics in enhancing cognitive services. This integration not only improves operational efficiency but also fosters a culture of data-driven innovation within the cognitive services-platform market.

Growing Focus on Customer Experience

Enhancing customer experience remains a pivotal driver in the cognitive services-platform market. Companies are increasingly adopting cognitive services to personalize interactions and improve service delivery. By utilizing natural language processing and sentiment analysis, businesses can better understand customer preferences and tailor their offerings accordingly. This focus on customer-centric solutions is reflected in the projected growth of the customer experience management market, which is anticipated to reach $14 billion by 2026. As organizations strive to differentiate themselves in a competitive landscape, the cognitive services-platform market is likely to see heightened investment in technologies that enhance customer engagement and satisfaction.

Increased Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the cognitive services-platform market. Companies are allocating substantial resources to innovate and enhance their cognitive service offerings. This focus on R&D is essential for staying competitive in a rapidly evolving technological landscape. Recent data indicates that R&D spending in the technology sector is expected to exceed $200 billion by 2025, highlighting the commitment to advancing cognitive technologies. As organizations strive to develop cutting-edge solutions, the cognitive services-platform market is poised for growth, with new advancements likely to emerge from ongoing research efforts.