Advancements in Pump Technology

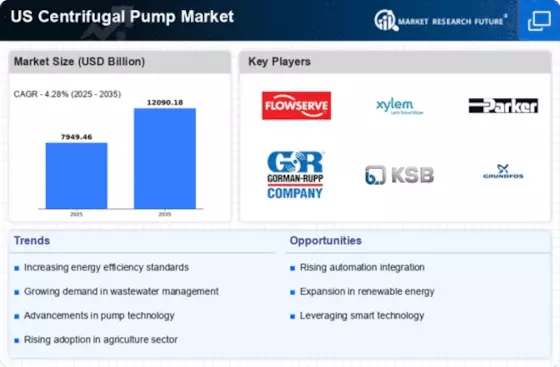

The US Centrifugal Pump Market is witnessing transformative advancements in pump technology, which are enhancing performance and reliability. Innovations such as variable frequency drives (VFDs) and smart monitoring systems are becoming increasingly prevalent, allowing for real-time performance tracking and optimization. These technological improvements not only increase the efficiency of centrifugal pumps but also extend their operational lifespan. As industries seek to reduce downtime and maintenance costs, the adoption of these advanced technologies is likely to accelerate, contributing to a projected market growth rate of around 6% over the next five years.

Focus on Energy Efficiency and Sustainability

The US Centrifugal Pump Market is increasingly shaped by a growing emphasis on energy efficiency and sustainability. Regulatory bodies and industry standards are pushing for the adoption of energy-efficient pumps that not only reduce operational costs but also minimize environmental impact. The Energy Policy Act and various state-level initiatives encourage the use of high-efficiency centrifugal pumps, which are designed to consume less energy while maintaining performance. This shift towards sustainable practices is expected to drive innovation within the market, as manufacturers invest in developing advanced technologies that align with these regulatory frameworks.

Industrial Growth and Manufacturing Expansion

The US Centrifugal Pump Market is significantly influenced by the robust growth of various industrial sectors, including oil and gas, chemical processing, and food and beverage. The manufacturing sector has shown resilience, with a reported increase in production activities, which in turn drives the demand for centrifugal pumps. Data suggests that the industrial segment constitutes a substantial share of the market, with centrifugal pumps being essential for fluid transfer and processing. As industries continue to expand, the need for reliable and efficient pumping solutions is likely to propel market growth, potentially reaching a valuation of over $3 billion by 2027.

Rising Investment in Infrastructure Development

The US Centrifugal Pump Market is poised for growth due to rising investments in infrastructure development across the country. Federal and state governments are allocating substantial budgets for upgrading aging infrastructure, particularly in water supply and wastewater treatment facilities. This influx of capital is expected to drive demand for centrifugal pumps, which are critical components in these systems. Recent reports indicate that infrastructure spending could exceed $1 trillion over the next decade, creating a favorable environment for the centrifugal pump market. As new projects are initiated, the need for reliable pumping solutions will likely increase, further bolstering market prospects.

Growing Demand in Water and Wastewater Management

The US Centrifugal Pump Market is experiencing a notable surge in demand driven by the increasing need for efficient water and wastewater management systems. As urbanization accelerates, municipalities are investing heavily in infrastructure upgrades, which include the installation of advanced centrifugal pumps. According to recent data, the water and wastewater sector accounts for a significant portion of the centrifugal pump market, with projections indicating a growth rate of approximately 5% annually through 2028. This trend is further supported by federal and state initiatives aimed at improving water quality and sustainability, thereby enhancing the market's potential.