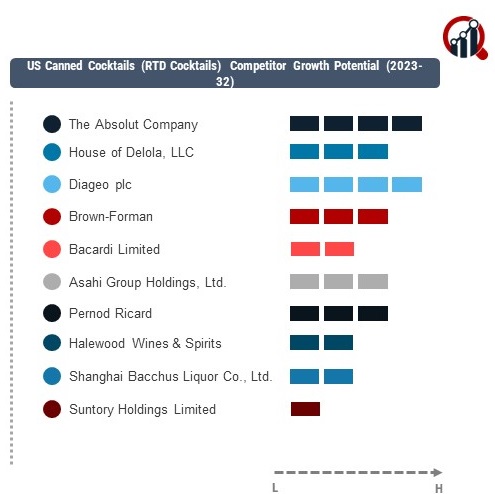

Top Industry Leaders in the US Canned Cocktails (RTD Cocktails) Market

Strategies Adopted by Us Canned Cocktails Rtd Cocktail Key Players

The market for ready-to-drink (RTD) cocktails in the United States has witnessed remarkable growth in recent years, driven by consumer demand for convenient, high-quality beverages. The competitive landscape of this market is shaped by key players, their strategic initiatives, market share factors, emerging companies, industry news, investment trends, the overall competitive scenario, and recent developments, particularly in the year 2023.

List of Key Players

- The Absolut Company

- House of Delola, LLC

- Diageo plc

- Brown-Forman

- Bacardi Limited

- Asahi Group Holdings, Ltd.

- Pernod Ricard

- Halewood Wines & Spirits

- Shanghai Bacchus Liquor Co., Ltd.

- Suntory Holdings Limited

- Manchester Drinks Company Ltd.

- Anheuser-Busch InBev

Key players in the US canned cocktails market are employing diverse strategies to maintain and enhance their positions. One prevalent strategy involves product innovation, with companies introducing new flavors and cocktail combinations to cater to evolving consumer preferences. For instance, White Claw has expanded its product line with various flavor offerings, continuously adapting to changing taste trends.

Brand promotion and marketing play a crucial role, with companies investing in advertising campaigns and collaborations to increase brand visibility and loyalty. Additionally, strategic partnerships with retailers and distributors are common, ensuring widespread availability and shelf space for their RTD cocktail products.

Factors for Market Share Analysis

Several factors contribute to the analysis of market share in the US canned cocktails/RTD cocktails sector. Product quality, brand recognition, pricing strategies, distribution efficiency, and the ability to adapt to changing consumer preferences are key determinants. Companies that effectively manage these factors tend to secure a larger share of the market.

New and Emerging Companies

The US canned cocktails market has seen the emergence of new and innovative players aiming to carve their niche in the industry. These companies often focus on unique flavor profiles, sustainable packaging, or niche target markets. Examples include Two Chicks Cocktails, which emphasizes natural ingredients and gluten-free options, and Flying Embers, known for its hard kombucha-based cocktails.

These emerging companies bring a sense of dynamism to the market, challenging established players and prompting the industry to continuously evolve. In some cases, they introduce creative packaging solutions or experiment with uncommon ingredients to differentiate themselves in a crowded market.

Industry News and Current Company Updates

Recent industry news highlights the dynamic nature of the US canned cocktails market. Notably, companies have been exploring collaborations with popular bars and mixologists to create signature RTD cocktails, bringing the expertise of craft cocktail creators to the convenience of a can. Additionally, there is a growing trend of incorporating sustainable practices in packaging and production processes, aligning with consumer preferences for eco-friendly options.

Investment Trends

Investment in the US canned cocktails/RTD cocktails sector reflects the industry's growth potential. Investors are keenly interested in companies that demonstrate innovation, market responsiveness, and sustainability. Funding rounds often support product development, marketing efforts, and expansion into new markets. The trend towards healthier alcoholic beverage options has also attracted investment in brands that offer lower-calorie or sugar-free RTD cocktails.

Overall Competitive Scenario

The overall competitive scenario in the US canned cocktails market is characterized by intense competition among established players and the entry of new and agile companies. While larger brands leverage their resources and distribution networks, smaller players focus on differentiation through unique flavors, packaging innovations, and targeted marketing.

The market is further influenced by consumer trends such as the preference for lower-alcohol content, health-conscious choices, and interest in diverse and exotic flavors. Adapting to these trends and effectively communicating the value proposition to consumers are essential aspects of maintaining a competitive edge.

Recent Development

The US canned cocktails/RTD cocktails market experienced noteworthy developments. A significant trend was the rise of premiumization within the sector. Established brands and new entrants alike introduced higher-end, sophisticated cocktail options to cater to consumers seeking a more elevated drinking experience. This shift included the introduction of premium ingredients, upscale packaging, and a focus on craftsmanship, positioning RTD cocktails as a viable alternative to traditional mixed drinks.

Furthermore, there was a surge in the popularity of unique flavor combinations. Companies launched limited-edition and seasonal flavors, aiming to capture consumer interest and drive sales. This strategy aligns with the consumer demand for variety and novelty in the RTD cocktail segment.

In response to growing environmental concerns, there was an increased emphasis on sustainable packaging. Companies explored eco-friendly materials, reduced packaging waste, and communicated their commitment to sustainability, responding to consumer expectations for responsible business practices.

Additionally, strategic acquisitions played a role in shaping the market landscape in 2023. Larger beverage companies sought to strengthen their presence in the RTD cocktails sector by acquiring successful and innovative brands. These acquisitions aimed to diversify product portfolios and tap into the growing consumer base for convenient and flavorful alcoholic beverages.