Growing Consumer Acceptance

The US Cannabis Market is experiencing a notable shift in consumer attitudes towards cannabis products. As more states legalize cannabis for recreational and medicinal use, public perception is evolving. Surveys indicate that approximately 68% of Americans support legalization, reflecting a growing acceptance. This trend is likely to drive demand for cannabis products, as consumers become more comfortable with their use. Furthermore, the increasing visibility of cannabis in mainstream media and culture contributes to this acceptance, potentially expanding the market base. As a result, businesses within the US Cannabis Market may find new opportunities to cater to a broader audience, including those who previously avoided cannabis due to stigma.

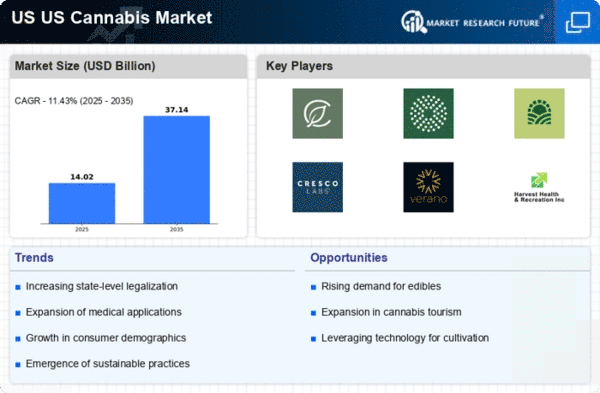

Expansion of Medical Cannabis Programs

The US Cannabis Market is significantly influenced by the expansion of medical cannabis programs across various states. Currently, over 30 states have legalized medical cannabis, providing patients with access to therapeutic options for conditions such as chronic pain, anxiety, and epilepsy. This expansion not only increases the number of patients eligible for medical cannabis but also encourages research into its benefits. The market for medical cannabis is projected to grow substantially, with estimates suggesting it could reach $13.2 billion by 2025. This growth is likely to attract investment and innovation within the US Cannabis Market, as companies seek to develop new products and services tailored to medical users.

Regulatory Developments and Compliance

The regulatory landscape surrounding the US Cannabis Market is continually evolving, impacting how businesses operate. As states implement new regulations, companies must navigate complex compliance requirements, which can be both a challenge and an opportunity. For instance, states like California and Colorado have established comprehensive frameworks for cannabis businesses, including licensing, taxation, and safety standards. These regulations can create barriers to entry for smaller players but also ensure product quality and consumer safety. As the industry matures, it is likely that federal regulations will also evolve, potentially leading to a more unified framework that could further stimulate growth in the US Cannabis Market.

Emerging Trends in Edibles and Beverages

The US Cannabis Market is witnessing a surge in the popularity of cannabis-infused edibles and beverages. This trend is driven by consumer preferences for alternative consumption methods that offer discreet and convenient options. The edibles segment is projected to grow significantly, with estimates suggesting it could account for over 25% of the total cannabis market by 2026. Companies are increasingly experimenting with flavors and formulations to attract a diverse consumer base, including those who may not prefer traditional smoking methods. This diversification within the US Cannabis Market is likely to create new opportunities for brands to differentiate themselves and capture market share.

Technological Advancements in Cultivation

Technological advancements are playing a crucial role in shaping the US Cannabis Market, particularly in cultivation practices. Innovations such as hydroponics, aeroponics, and advanced lighting systems are enabling growers to increase yields and improve product quality. For example, the use of LED lighting has been shown to enhance plant growth while reducing energy costs. Additionally, data analytics and automation are becoming integral to cultivation, allowing for more efficient resource management. These advancements not only improve profitability for growers but also contribute to sustainability efforts within the US Cannabis Market. As technology continues to evolve, it is likely to drive further innovation and competitiveness in the market.