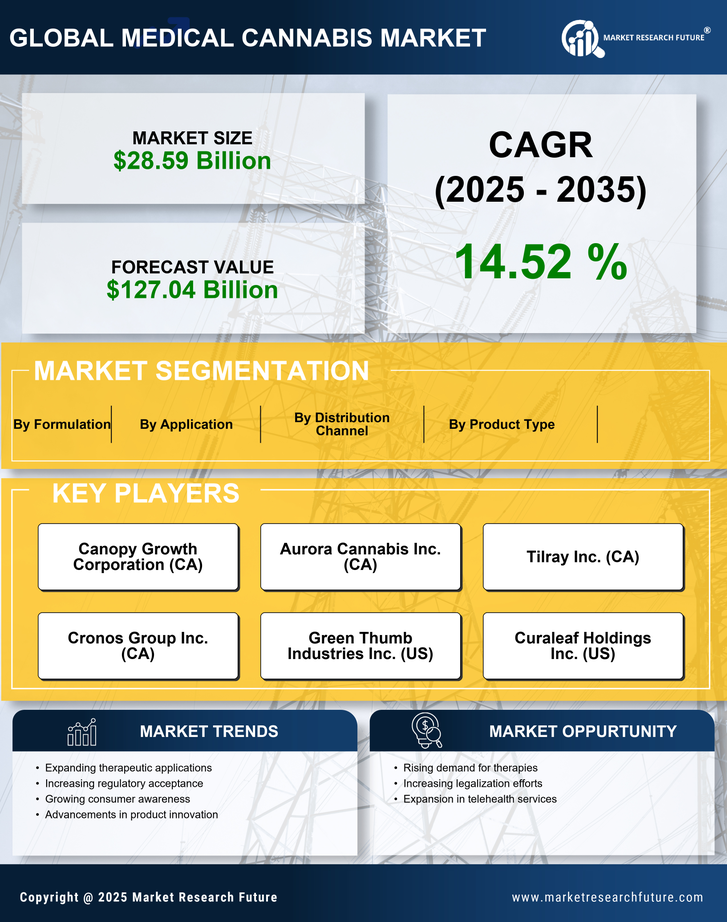

The Global Medical Cannabis Market has witnessed significant growth and diversification, driven by an increasing acceptance of cannabis for medicinal purposes across various jurisdictions. This market is characterized by a mix of established players and emerging companies that are working to capitalize on the expanding consumer base and evolving regulatory landscape.

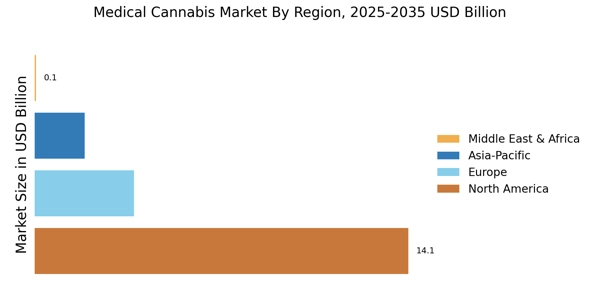

The global cannabis and CBD market has evolved into a regulated, high-growth industry driven by legalization, medical adoption, and wellness trends. The U.S. remains the largest market, supported by state-level legalization, while Europe and Latin America are emerging growth regions. CBD products dominate wellness and pharmaceutical channels due to non-psychoactive properties. Innovation in cultivation technology, pharmaceutical-grade formulations, and compliance-driven manufacturing is shaping the competitive landscape. Despite regulatory complexities, the industry is expected to maintain strong double-digit growth over the next decade.

Competitive insights reveal a dynamic environment where companies strive to innovate through product development and differentiation while navigating stringent compliance parameters.

The competitive landscape is influenced by factors such as research and development capabilities, distribution networks, and partnerships, which play crucial roles in shaping market positioning and consumer engagement. As the market matures, companies are increasingly focusing on quality assurance and patient education, positioning themselves as trustworthy sources of medical cannabis products.

Trulieve has positioned itself as a strong contender in the Global Medical Cannabis Market, leveraging its extensive cultivation and retail footprint to gain market share. With a robust product catalog that includes various forms of cannabis, such as oils, capsules, and edibles, Trulieve successfully caters to diverse patient needs.

The company’s strategic presence in multiple regions allows it to optimize its distribution channels and connect with a vast consumer base. Known for its commitment to high-quality products and customer service, Trulieve's strengths lie in its operational efficiency and a solid reputation built on reliability.

This approach not only solidifies customer loyalty but also enhances its brand value within the global market, allowing it to maintain a competitive edge amid evolving industry dynamics. Aphria is another key player in the Global Medical Cannabis Market trends, recognized for its innovative approach and a wide range of products tailored to the medical sector.

The company offers an extensive lineup of cannabis oils, capsules, and dried flower products, catering to the specific therapeutic needs of patients around the globe. Aphria's market presence is bolstered by strategic partnerships and acquisitions that enhance its operational capabilities and expand its reach.

This includes collaborations aimed at advancing research on cannabis applications in medicine, which reinforces its commitment to quality and efficacy. Additionally, Aphria's strengths lie in its robust supply chain management, adherence to regulatory standards, and ongoing focus on sustainability. As the global market continues to evolve, Aphria maintains a strong position through its dedication to innovation and effective governance practices.