Aging Population

The US Denture Adhesive Market is significantly influenced by the aging population, which is projected to grow substantially in the coming years. As individuals age, the prevalence of dental issues increases, leading to a higher demand for dentures and, consequently, denture adhesives. According to the US Census Bureau, by 2030, all baby boomers will be over 65, which will increase the number of individuals requiring dental solutions. This demographic shift suggests that the market for denture adhesives will likely expand, as older adults seek reliable products to enhance their quality of life. Furthermore, the growing awareness of oral health among seniors may drive them towards using effective denture adhesives, thereby boosting the overall market growth.

E-commerce Growth

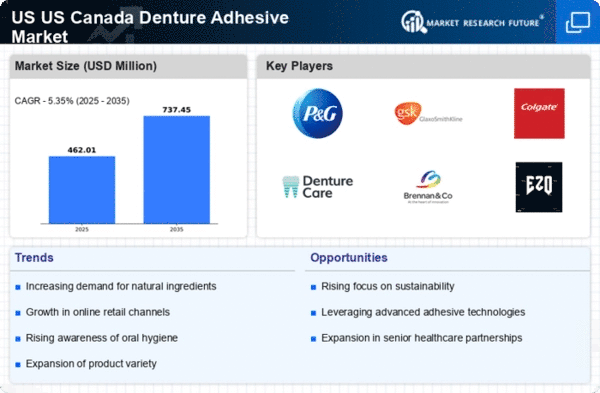

The rapid growth of e-commerce is reshaping the landscape of the US Denture Adhesive Market. With more consumers turning to online shopping for convenience, the availability of denture adhesives through various e-commerce platforms is expanding. This shift not only provides consumers with a wider range of product options but also facilitates easy access to customer reviews and product information. Market data suggests that online sales of denture adhesives are increasing, as consumers appreciate the ability to compare products and prices from the comfort of their homes. As e-commerce continues to grow, it is likely to play a pivotal role in driving sales and enhancing market reach for manufacturers in the denture adhesive sector.

Health and Wellness Trends

The growing health and wellness trends in the United States are influencing consumer preferences in the US Denture Adhesive Market. As more individuals prioritize their health, there is a noticeable shift towards products that are perceived as safe and beneficial. Consumers are increasingly seeking denture adhesives that are free from harmful chemicals and made from natural ingredients. This trend is supported by Market Research Future indicating that products marketed as 'natural' or 'organic' tend to perform better in sales. Consequently, manufacturers are adapting their product lines to align with these health-conscious preferences, which may lead to a broader acceptance of denture adhesives among consumers who previously avoided them due to safety concerns.

Technological Advancements

Technological advancements in the formulation of denture adhesives are playing a crucial role in the US Denture Adhesive Market. Innovations in adhesive technology have led to the development of products that offer improved adhesion, comfort, and ease of use. For instance, the introduction of water-resistant adhesives has enhanced the user experience, allowing for longer-lasting hold even in challenging conditions. Market data indicates that companies investing in research and development are likely to capture a larger market share, as consumers increasingly prefer high-performance products. This trend towards innovation not only meets consumer demands but also positions manufacturers favorably in a competitive landscape, potentially leading to increased sales and market penetration.

Increased Awareness and Education

Increased awareness and education regarding oral health are driving growth in the US Denture Adhesive Market. Dental professionals and organizations are actively promoting the importance of proper denture care, which includes the use of effective adhesives. Educational campaigns aimed at older adults emphasize the benefits of using quality denture adhesives for improved comfort and functionality. This heightened awareness is likely to result in increased sales, as consumers become more informed about the options available to them. Furthermore, as more individuals recognize the importance of maintaining their oral health, the demand for reliable denture adhesives is expected to rise, thereby positively impacting the market.